|

Extraordinary Council Meeting Agenda Thursday, 17 June 2021 9.00am Council Chamber, 28-32 Ruataniwha Street, Waipawa |

|

Extraordinary Council Meeting Agenda Thursday, 17 June 2021 9.00am Council Chamber, 28-32 Ruataniwha Street, Waipawa |

|

Extraordinary Council Meeting Agenda |

17 June 2021 |

3 Declarations of Conflicts of Interest

5.1 Minutes of the Council Meeting held on 3 June 2021

6.1 Endorsement of Asset Management Plans

6.2 Adoption of Long Term Plan 2021 - 2031

6.3 Setting of Rates for 2021/2022

1 Karakia

3 Declarations of Conflicts of Interest

|

RECOMMENDATION THAT the following standing orders are suspended for the duration of the meeting: · 21.2 Time limits on speakers · 21.5 Members may speak only once · 21.6 Limits on number of speakers · THAT 22.4 Option C under section 22 General procedures for speaking and moving motions be used for the meeting. |

|

17 June 2021 |

5.1 Minutes of the Council Meeting held on 3 June 2021

File Number: COU1-1400

Author: Caitlyn Dine, Governance & Support Officer

Authoriser: Monique Davidson, Chief Executive

Attachments: 1. Minutes of the Council Meeting held on 3 June 2021

1. That the minutes of the meeting of the Council held on 3 June 2021 be received.

|

3 June 2021 |

MINUTES OF Central Hawkes Bay District Council

Council Meeting

HELD AT THE Council Chamber, 28-32

Ruataniwha Street, Waipawa

ON Thursday, 3 June 2021 AT 9.00am

PRESENT: Mayor Alex Walker

Deputy Mayor Kelly Annand

Cr Jerry Greer

Cr Exham Wichman

Cr Brent Muggeridge

Cr Tim Aitken

Cr Gerard Minehan

Cr Kate Taylor

Cr Pip Burne

Kaiarahi Matua Roger Maaka

IN ATTENDANCE: Monique Davidson (Chief Executive)

Brent Chamberlain (Chief Financial Officer)

Nicola Bousfield (Group Manager, People and Business Enablement)

Doug Tate (Group Manager, Customer and Community Partnerships)

Darren de Klerk (Director Projects and Programmes)

Joshua Lloyd (Group Manager, Community Infrastructure and Development)

Caitlyn Dine (Governance and Support Officer)

1 Karakia

Councillor Exham led the Karakia

2 Apologies

Nil

3 Declarations of Conflicts of Interest

Councillor Aitken declared a conflict of interest on report 7.3 and he advised he would leave the room for the conversation.

4 Standing Orders

|

Resolved: 21.70 Moved: Cr Gerard Minehan Seconded: Cr Pip Burne THAT the following standing orders are suspended for the duration of the meeting: 20.2 Time limits on speakers 20.5 Members may speak only once 20.6 Limits on number of speakers And that Option C under section 21 General procedures for speaking and moving motions be used for the meeting. Standing orders are recommended to be suspended to enable members to engage in discussion in a free and frank manner. Carried |

5 Confirmation of Minutes

|

Resolved: 21.71 Moved: Cr Kate Taylor Seconded: Deputy Mayor Kelly Annand That the minutes of the Ordinary Council Meeting held on 13 May 2021 and the Extraordinary Council Meeting held on 27 May 2021 as circulated, be confirmed as true and correct as amended. Carried |

6 Reports from Committees

|

6.1 Minutes of the Strategy and Wellbeing Committee Meeting held on 6 May 2021 |

|

Resolved: 21.72 Moved: Deputy Mayor Kelly Annand Seconded: Cr Pip Burne 1. That the minutes of the meeting of the Strategy and Wellbeing Committee held on 6 May 2021 be received. Carried |

|

6.2 Minutes of the Finance and Infrastructure Committee Meeting held on 22 April 2021 |

|

Resolved: 21.73 Moved: Cr Exham Wichman Seconded: Cr Brent Muggeridge 1. That the minutes of the meeting of the Finance and Infrastructure Committee held on 22 April 2021 be received. Carried |

|

6.3 Minutes of the Risk and Assurance Committee Meeting held on 27 May 2021 |

|

Resolved: 21.74 Moved: Cr Tim Aitken Seconded: Cr Jerry Greer 1. That the minutes of the meeting of the Risk and Assurance Committee held on 27 May 2021 be received. Carried |

7 Report Section

|

7.1 Resolution Monitoring Report |

|

Purpose The purpose of this report is to present to Council the Resolution Monitoring Report. This report seeks to ensure Council has visibility over work that is progressing, following resolutions from Council. |

|

Resolved: 21.75 Moved: Deputy Mayor Kelly Annand Seconded: Cr Kate Taylor That, having considered all matters raised in the report, the report be noted. Carried |

Mrs Davidson presented this report.

|

7.2 Quarterly Non-Financial Performance Report January - March 2021 |

|

PURPOSE The purpose of this report is to present to Council the Quarterly non-financial performance report for the period 1 January – 31 March 2021.

|

|

Resolved: 21.76 Moved: Cr Gerard Minehan Seconded: Deputy Mayor Kelly Annand That having considered all matters raised in the report: That the Quarterly Non-Financial Performance Report 1 January – 31 March 2021 be received. Carried |

Mr Chamberlain presented this report.

|

7.3 Appointment of Elected Member to Independent Commissioner Evaluation Panel |

|

PURPOSE The purpose of this report is for Council to consider the appointment of a Councillor to the Independent Commissioner Evaluation Panel.

|

|

Resolved: 21.77 Moved: Cr Kate Taylor Seconded: Cr Brent Muggeridge That having considered all matters raised in the report: a) That Council appoint Councillor Tim Aitken as the elected member on the Independent Commissioner Evaluation Panel for Expression of Interest C1131. Carried |

Mr Tate presented this report.

Councillor Aitken left the room at 9:36sm as he declared conflict of interest being the discussion in this report.

Councillor Aitken re-joined the meeting at 9:45am

Mayor Walker left reports 7.4 and 7.5 for Councillor Muggeridge to Chair and moved to Section 8 Mayor and Councillors reports.

8 Mayor and Councillor Reports

|

8.1 Mayor's Report for April - May 2021 |

|

EXECUTIVE SUMMARY The purpose of this report is to present Her Worship the Mayor’s report. This report will be presented to Council on the day.

|

|

Resolved: 21.79 Moved: Cr Gerard Minehan Seconded: Cr Kate Taylor That the Mayor’s report for April – May 2021 be received. Carried |

Mayor Walker presented this report.

|

8.2 Strategy and Wellbeing Committee Chair Report |

|

purpose The purpose of this report is to present the Strategy and Wellbeing Committee Chair Report.

|

|

Resolved: 21.80 Moved: Deputy Mayor Kelly Annand Seconded: Cr Exham Wichman That the Strategy and Wellbeing Committee Chair Report for May 2021 be received. Carried |

Deputy Mayor Councillor Annand presented this report.

|

8.3 Ruataniwha Ward Report |

|

Purpose The purpose of this report is to present the Ruataniwha Ward Report. |

|

Resolved: 21.81 Moved: Deputy Mayor Kelly Annand Seconded: Cr Pip Burne That the Ruataniwha Ward Report for April – May 2021 be received. Carried |

Deputy Mayor Councillor Annand presented this report.

|

8.4 Aramoana/Ruahine Ward Report |

|

Purpose The purpose of this report is to present the Aramoana/Ruahine Ward Report. |

|

Resolved: 21.82 Moved: Cr Tim Aitken Seconded: Cr Jerry Greer That the Aramoana/Ruahine Ward Report for April - May 2021 be received Carried |

Councillor Aitken presented this report.

9 Chief Executive Report

|

9.1 Organisation Performance and Activity Report April - May 2021 |

|

PURPOSE The purpose of this report is to present to Council the organisation report for April – May 2021.

|

|

Resolved: 21.83 Moved: Cr Tim Aitken Seconded: Cr Kate Taylor That, having considered all matters raised in the report, the report be noted. Carried |

Mrs Davidson presented this report.

|

9.2 Handing over the Chair |

|

Resolved: 21.84 Moved: Mayor Alex Walker Seconded: Cr Jerry Greer That Mayor Walker under Standing Order 14.1 vacate the Chair and Council agree for Councillor Muggeridge to take over the Chair. Carried |

Council went back to reports 7.4 and 7.5.

|

7.4 2020/2021 Year End Financial Forecast |

|

PURPOSE The purpose of this report is to inform Councillors about Council’s expected year-end financial position. Due to the timing of the next Finance and Infrastructure Committee meeting, this report is presented to Council.

|

|

Resolved: 21.78 Moved: Cr Pip Burne Seconded: Cr Exham Wichman That, having considered all matters raised in the report, the report be noted. Carried |

Mr Chamberlain presented this report.

|

7.5 Kairakau Water Upgrade - Project Update (Hardness) |

|

PURPOSE The matter for consideration by the Council is to provide Council with an update on the project and for Council to decide on whether to proceed with Water Hardness treatment as part of the Drinking Water Upgrade Project. This being a follow up action from the Finance and Infrastructure Committee meeting on the 25th February 2021 outlined below, particularly item D; a) The Finance and Infrastructure Committee approve Option 1 to upgrade and construct a water treatment plant to meet DWSNZ and safeguard ongoing water supply. b) The Finance and Infrastructure Committee approve to locate the new treatment plant on land outlined in Scenario 2 – being to lease the existing Manawarakau Trust land neighbouring the existing spring and raw water storage c) The Finance and Infrastructure Committee approve to increase the project budget to $850,000 using existing waters budgets and/ or Tranche One – 3 Waters stimulus funding while ensuring no impact on rates. d) That officers do additional work on the removal of the hardness in the water to meet community outcomes and report back to the Finance and Infrastructure Committee for consideration as part of the Long Term Plan 2021 – 2031 e) That Council continue to monitor changes in regulations and guidance from Taumata Arowai on the roof water supply

|

|

RECOMMENDATION for consideration That having considered all matters raised in the report: a) That council approve to include water hardness into the treatment process – with an expected budget of $140,000 for treatment equipment b) That council approve to in the short term collect the hardness treatment waste (brine) on site and tanker off site periodically at a lower CAPEX, but ongoing OPEX – within budget increase requested above.

d) That council increase the project budget from $850,000 to $990,000 using existing Long Term Plan 2021 – Year One set budgets.

|

|

Amendment Moved: Mayor Alex Walker Seconded: Cr Kate Taylor C) That Council continues to investigate the longer term solutions for discharge of the by-product from the softening process. Further CAPEX funding to be requested once understood. Carried |

Mr de Klerk and Mr Kilduff presented this report.

Mayor Walker asked to amend resolution C.

Meeting adjourned at 11.00am for a morning tea break.

Meeting resumed at 11:30am into Public Excluded business.

10 Public Excluded Business

RESOLUTION TO EXCLUDE THE PUBLIC

|

Resolved: 21.85 Moved: Cr Exham Wichman Seconded: Deputy Mayor Kelly Annand That the public be excluded from the following parts of the proceedings of this meeting. The general subject matter of each matter to be considered while the public is excluded, the reason for passing this resolution in relation to each matter, and the specific grounds under section 48 of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution are as follows:

Carried |

11 Date of Next Meeting

|

Resolved: 21.86 Moved: Cr Gerard Minehan Seconded: Cr Kate Taylor THAT the next meeting of the Central Hawke's Bay District Council be held on 17 June 2021. Carried |

12 Time of Closure

The Meeting closed at 12:35pm.

The minutes of this meeting were confirmed at the Council Meeting held on 17 June 2021.

...................................................

CHAIRPERSON

|

17 June 2021 |

6.1 Endorsement of Asset Management Plans

File Number: COU1-1400

Author: Josh Lloyd, Group Manager - Community Infrastructure and Development

Authoriser: Monique Davidson, Chief Executive

Community Buildings and Property

The matter for consideration by the Council is the endorsement of the Asset Management Plans.

RECOMMENDATION for consideration

That having considered all matters raised in the report:

a) That Council endorse the Asset Management Plans that have been developed to form the basis of the 30-year Infrastructure Strategy and 2021 - 2031 Long Term Plan.

significance and engagement

This report is provided for information purposes, and while endorsement is sought of the Asset Management Plans given its relationship to the Long Term Plan 2021-2031, the decision to endorse the Asset Management Plans themselves, has been assessed as not significant.

BACKGROUND

Councils 2021 – 2031 Long Term Plan (the Plan) sets out the delivery of services across the range of Council activities for the ten years. The Plan provides an explanation of key services being delivered, those expected to change and importantly the costs associated with each activity. Underlying the Plan is a further level of detail for each activity that in a more comprehensive way provides certainty on the objectives, levels of service and work/resources to deliver. These more detailed plans are referred to in the organisation as Asset or Activity Management Plans (AMPs).

The terms ‘Asset’ and ‘Activity’ Management Plans are largely interchangeable with both serving the same purpose but ‘Asset’ being used to identify those activity classes that are more dependent on assets rather than services to deliver value. Critically these ‘Asset’ Management Plans feed into the adopted Infrastructure Strategy as well as the LTP.

A significant amount of work has been completed in the organisation since the AMPs were last completed and published in 2018. The organisation has largely the same challenges that it had in 2018 but the understanding of these challenges and the confirmation of work plans and priorities to address these challenges has greatly increased. There has also been a significant step change in the level of formality applied to planning in some asset/infrastructure ‘’heavy’ activities. The culmination of the above has resulted in AMPs that are considerably different and vastly improved upon from those that were created in 2018.

Historically the Council table has not had direct visibility of the AMPs as they have been considered to sit a level of operational detail not necessary for governance to be across. This year Officers wish to share the AMPs as it is considered important for governance to have line of sight through the spectrum of decision making as it relates to our activities.

DISCUSSION

Officers are seeking to provide detail to Council about the various plans to manage each of the organisations asset-focussed activities through the period of the LTP. Attached to this report are full copies of completed AMPs for:

· Land Transport

· 3 Waters

· Solid Waste

· Community Buildings and Property

· Parks and Open Spaces

The AMPs attached have been prepared by Officers and represent the full set of plans to deliver services with respect to the relevant activity. The AMPs have fed through into the adopted Infrastructure Strategy and budgets have been modelled through into the adopted Financial Strategy. The AMPs in each case are constructed differently by Council’s Asset Managers but contain the same necessary information about purpose, objectives, levels of service, state of the assets, approach to planning and decision making and ultimately the plans to maintain, replace and upgrade the assets themselves.

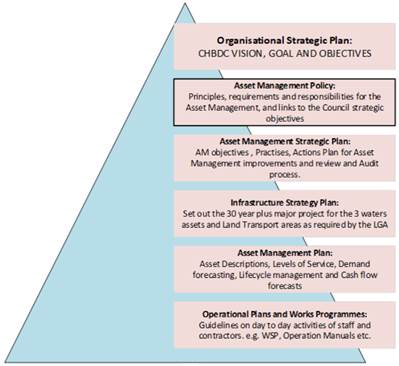

AMPs are an integral part of Councils Asset Management System (the System) which is the acknowledged approach to how Council coordinates its various activities, processes and resources to deliver asset management outcomes. The System is not formal or documented in some cases and this is a known area for improvement. At its simplest, the system can be used to depict the interaction between various levels of decision making within asset management:

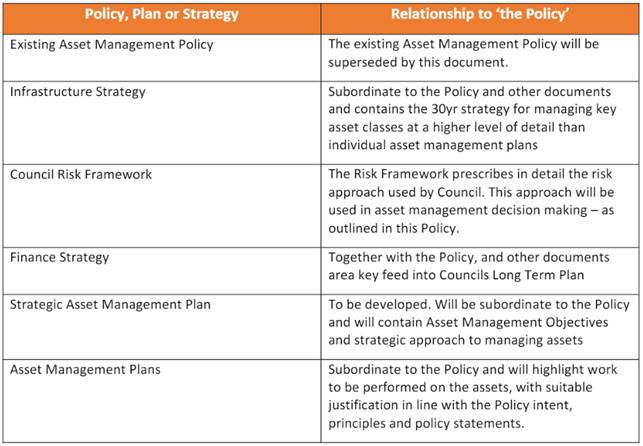

As shown the AMPs sit toward the lower levels of the hierarchy of documentation within the System and represent a more tactical and operational approach to asset management. The table below further explains the relationship of the AMPs and other artefacts in the System, as well as some other key Council documents, with respect to the Asset Management Policy (the Policy). The Policy is used as a reference point as it is the first (highest) order document in the System.

Below each AMP is summarised with attention given to the key areas of divergence from previous versions of the AMP.

Land Transport AMP.

Areas of Focus.

This AMP presents a continued focus on maintaining levels of service on the transport network as guided by several external constraints and inputs such as the One Network Road Classification and Waka Kotahi’s programme, funding and audit/review processes. Specifically, the plan presents a programme of work that is considered to strengthen CHBs existing road network and build a stronger case to Waka Kotahi for continued support and investment.

Areas of Divergence from Previous AMPs.

The Land Transport activity has benefited from a relatively high level of asset management expertise through previous versions of the AMP so this AMP is not significantly different from previous versions. This version makes specific reference to community values and Project THRIVE aspirations and provides an update and new information with respect to the technical parameters of the network.

Key Projects/Plans.

The AMP presents a number of rolling programmes of work that are each justified based on engineering and asset management expertise. The programmes cover planned and reactive maintenance tasks, general upgrades and improvement to enhance safety and road-user experience and a continued focus on higher value and higher risk programmes that relate to our many structures (bridges, walls and culverts).

3 Waters AMP.

Areas of Focus.

This AMP has focussed significantly on two key areas being Compliance and Renewals. There are significant programmes of work underway already and further planned to meet new and increasing compliance standards across our waters assets with Wastewater treatment and discharge at the forefront and needing the largest investment. Renewal programmes of ageing reticulation assets are also a key focus area with known risk in the network from continued and increasing frequencies of pipe failures.

Areas of Divergence from Previous AMPs.

This AMP is significantly different from previous versions in that a much more sophisticated and rigorous approach has been used to determine network/asset constraints and programmes of work to address those constraints. This is true for both low-volume high risk assets and also for high-volume lower risk assets.

Low-volume high risk assets such as treatment plants, reservoirs and pumping equipment have benefited from a sustained period of intensive investment in improving the understanding of asset condition and performance. This is most notably evidenced with the plans developed to support now known issues at our wastewater treatment plants, at our reservoirs and with our water supply security risk in Waipukurau.

High-volume low risk assets such as pipe and general plant networks have benefited from recent improved asset management rigor utilising largely available existing asset data to inform decision making about necessary replacement volumes and locations based on risk. Comprehensive models of complete pipe networks have been developed to assess every listed asset for risk in terms of likelihood and consequence of failure. These models have been enhanced with the most up to date information available on asset condition and overlaid across existing work programmes to optimise investment plans. The result is a drastically enhanced view of reticulation asset risk and plans to mitigate.

Key Projects/Plans.

The AMP presents a number of listed projects as well as targeted rolling programmes of work to maintain and improve the asset base. Listed projects include:

· Improvements to all 6 wastewater treatment and discharge schemes

· Further stages of work to connect the Waipawa and Waipukurau drinking water supplies to build resilience

· The replacement of multiple reservoirs

· Significant amounts of pipe renewal

Solid Waste AMP.

Areas of Focus.

This AMP supports an activity (Solid Waste) that is not majority-driven by asset management outcomes but instead by service offerings. The primary asset of significance for the Solid Waste activity is the district landfill and secondary significant assets are the districts transfer stations. The remainder of the activity is delivered through the provision of physical service that rely on operational management rather than asset management. This AMP therefore focusses on the district landfill and transfer stations primarily and includes programmes of work to upgrade and maintain each.

Areas of Divergence from Previous AMPs.

This AMP is largely similar to previous versions but includes updated programmes of work based on current needs and drivers. It is considered by Officers that an opportunity exists in future periods to improve the sophistication of asset management planning for this activity to bring it in line with other asset classes while still being scaled appropriately relative to risk.

Key Projects/Plans.

Key projects in the AMP include:

· A new weighbridge at the Waipukurau transfer station facility

· Surface improvements to the greenwaste area at Waipukurau

· Te extension of the landfill into a new cell

· The development of a new purpose-built transfer station, re-use and recovery facility for the district.

Community Buildings and Property AMP.

Areas of Focus.

The focus of the Community Buildings and Property Asset Management Plan is to capture key components for continued operation and management. A thorough Community Facilities Strategy is planned for year one as well as continued development of the property and buildings asset register. The four key areas addressed by this asset management plan and their level of service statements are:

Community Facilities (community & commercial) are activated and vibrant community spaces that are well used by our community. This activity includes theatres, halls, swimming pools, museum, general property and the CHBDC Administration building (See Library Activity Plan for Library LOS and budget)

Public Toilets are clean, safe, in good working order and meet the needs of our community and visitors. They include public toilets open 24 hours along the main highways and in beach locations, public toilets in parks or situated with community halls that are open during the day, and toilets and changing rooms located in parks that are open only for sporting and special events.

Retirement Housing (48 Units): Safe, well maintained and comfortable community housing for our retired community is delivered through flats at Ruahine Place and Wellington Road (Waipukurau) and Kingston Place in Waipawa.

Campgrounds are commercial entities on Council leased land much of which falls on Reserve land. Campgrounds are in the parks and open spaces budget but due to the buildings being the focus they are covered in this asset management plan and include the Waipukurau Holiday Park, Blackhead Beach Campground, Pourerere Beach Campground. Kairakau Campground is found in Council Road Reserve.

Areas of Divergence from Previous AMPs.

This AMP demonstrates a need to move away from the typical historical renewals, by embarking on a community facilities strategy and asset management improvements so that the next LTP is able to demonstrate both strategic planning and a detailed plan of managing assets across the property and building portfolio.

Key Projects/Plans.

The Community Facilities Strategy is the number one focus for the first year of the LTP. This includes a community facility network plan which will play a large part in prioritising future activity in this area. Other activity includes supporting Waipukurau heated pool complex with EQ strengthening and continuing to bring Retirement Housing up to healthy homes standard and modernisations. Further into LTP is a focus on the Council Administration Building modernisations and years 9 and 10 have funding for EQ strengthening of the Memorial Hall and CHB Municipal Theatre.

Parks and Open Spaces AMP.

Areas of Focus.

The focus of Parks services is to provide public open space for the preservation and management of areas for the benefit and enjoyment of the public. Over 158ha of open space is made up of civic gathering spaces, sportsgrounds, passive green areas, playgrounds, planted streetscapes, coastal and native bush areas, as well as walkways and cycle ways that contribute to health, recreation and the liveability of Central Hawke’s Bay. AMP’s are ongoing documents continually being updated. This AMP details playground assets and their improvement programme.

Areas of Divergence from Previous AMPs.

Prior AMPS focussed specifically on the assets. This AMP addresses the public experiential interface especially in the play assets section (5.2.1). The additional knowledge of the Integrated Spatial plan has also helped to identify a number of growth projects.

Key Projects/Plans.

There are large number of projects over the life of the LTP, but the first three years focus on the parks network plan and walking cycling plan which are all linked to Community Facilities Strategy, a major upgrade for Nelly Jull Playground, and urban improvements for Otane and Waipukurau.

Implications ASSESSMENT

This report confirms that the matter concerned has no particular implications and has been dealt with in accordance with the Local Government Act 2002. Specifically:

· Council staff have delegated authority for any decisions made;

· Council staff have identified and assessed all reasonably practicable options for addressing the matter and considered the views and preferences of any interested or affected persons (including Māori), in proportion to the significance of the matter;

· Any decisions made will help meet the current and future needs of communities for good-quality local infrastructure, local public services, and performance of regulatory functions in a way that is most cost-effective for households and businesses;

· Unless stated above, any decisions made can be addressed through current funding under the Long-Term Plan and Annual Plan;

· Any decisions made are consistent with the Council's plans and policies; and

· No decisions have been made that would alter significantly the intended level of service provision for any significant activity undertaken by or on behalf of the Council, or would transfer the ownership or control of a strategic asset to or from the Council.

Next Steps

Officers are pleased to hear feedback on the AMPs presented. Officers are taking action to deliver on the AMPs as they currently stand in order to meet the expectations set with community through the LTP.

|

RECOMMENDATION That having considered all matters raised in the report: a) That Council endorse the Asset Management Plans that have been developed to form the basis of the 30-year Infrastructure Strategy and 2021 - 2031 Long Term Plan. |

|

17 June 2021 |

6.2 Adoption of Long Term Plan 2021 - 2031

File Number: COU1-1400

Author: Monique Davidson, Chief Executive

Authoriser: Monique Davidson, Chief Executive

Attachments: 1. Minutes of 13 May Council Meeting ⇩

2. Audit Report ⇩

PURPOSE

The purpose of this report is to present to Council the 2021 – 2031 Long Term Plan for adoption.

RECOMMENDATION for consideration

That having considered all matters raised in the report:

a) That Council resolves that the Long Term Plan Budgets for financial years 2-10 (2023-2031) is not a balanced budget because operating revenues are not at a level sufficient to meet operating expenses primarily due to not fully funding depreciation as signalled in the financial strategy and balancing the budget sections of the Long Term Plan.

b) That Council resolves that setting an unbalanced budget for years 2-10 (2023-2031) is prudent in terms of section 100 of the Local Government Act 2002 given Council is undertaking significant catch up in deferred asset renewals and is unable to fully fund depreciation during the course of this Long Term Plan without further financially stressing its ratepayers, having had regard to the matters in section 100(2) of the Local Government Act 2002.

c) That Council note that Council is undertaking assets renewals at a rate faster than they are depreciating, meaning on average Councils assets are getting younger. This is achieved through a combination of rates and debt funding the renewals. While this strategy increases debt, Council maintains sufficient debt headroom and this temporary funding of renewals through debt does not financially distress the Council. It is Councils intention to revert to fully rate fund depreciation and renewals beyond 2031, thus returning Council to a balanced budget after this date. For these reasons Council believes it is prudent to run unbalanced budgets for 2023-2031.

d) That Council adopt the 2021-31 Long Term Plan in accordance with section 93G of the Local Government Act 2002.

e) That Council gives delegations to the Chief Executive to make any final edits, including minor changes from the audit process, to the Long Term Plan 2021 – 2031 ahead of formal publication.

f) That Council amends its fees and charges schedule for 2021/22 to include a fixed administration fee of per new lot created of $75 GST inclusive entitled “New Property File Creation”.

EXECUTIVE SUMMARY

Development of the Long Term Plan has progressed through numerous Council Workshops, Committee and Council meetings, and while formally beginning in May 2020, many of the building blocks have been developed over the last three years since the adoption of the 2018 – 2028 Long Term Plan.

Late February 2021 Council published its 2021-2031 Long Term Plan Consultation document and subsequently held a series of public meetings during March 2021 to consult on the proposed Long Term Plan. Also during March 2021 the public were requested to provide written feedback on the Long Term Plan.

In April 2021 those that through the written consultation process indicated they wished to, were invited to come into Council and verbally present their feedback direct to Councillors.

In May 2021 Council considered all the written feedback, verbal feedback, and officers advise, and resolved to make a number of changes to the long Term Plan based on this feedback. Officers then made these changes and Ernst Young audited them.

Today, Councillors are being presented with the final 2021-2031 Long Term Plan and are being asked to adopt the plan and proposed rates for 2021/22 that will enable this plan to be delivered.

BACKGROUND

What is a Long Term Plan (LTP)?

Council is required by legislation to adopt a Long Term Plan (LTP) and review it every three years.

The LTP sets out Council’s activities, plans, budgets and policies and must be adopted before the beginning of the first year it relates to and continues in force until the close of the third consecutive year to which it relates.

The Process

The process to develop the Long Term Plan 2021-2031 began in May 2020. Following this was a detailed and robust LTP pre-engagement process through June and July 2020 as part of our ‘Thriving Future’, building on the major community engagement process – Project Thrive completed in 2017. This information and community feedback has been valuable in the ongoing development and refinement of the LTP.

Development of the Long Term Plan has progressed through numerous Council Workshops, Committee and Council meetings. These regular workshops and meetings have provided a strong and robust platform for the basis of the Long Term Plan. During the terms of workshops and meetings, Council have received all of the components of the Long Term Plan including:

· Community Outcomes – these have been reviewed and updated along with seven strategic measures being added to measure the achievement of these outcomes during the life of the plan.

· The Levels of Service and Performance Measures – these have been updated based on the Asset Management Plans and Council feedback and form part of the Supporting Information contained in each group and activity statement.

· Revenue and Finance Policy –this has been reviewed and consulted on through a separate consultation in late 2020 and forms part of the supporting information.

· Groups of Activities – These have been reviewed and the text through all of the activities updated to reflect the range of services and activities Council provide.

· Financial Strategy – this has been reviewed and updated based on the current expectations of Council to facilitate prudent financial management.

· Infrastructure Strategy – has been updated to show the current significant infrastructure issues and how the Council will manage these over the next 30 years.

· Significant Assumptions – these have been reviewed and updated based on current information and best guidance, particularly in relation to the effects of COVID-19, Climate Change, and the Three Waters Reform Programme.

· Development Contributions – this policy has been reviewed with substantial changes based on the assumptions and budgets included within the Long Term Plan.

· The Budget and Rates requirements for the next ten years - these have been reviewed and form part of the overall consultation on the Long Term Plan.

In accordance with section 93B of the Local Government Act 2002 (LGA), officers developed a Consultation Document and Supporting Information that reflected the decisions made and to provide the basis for consultation with the community. The Consultation Document set out the issues and opportunities facing Central Hawke’s Bay, along with the key issues for consultation to inform the final LTP and the proposals and options put forward by Council. The Supporting Information includes the detailed information relied on to prepare the consultation document.

In accordance with section 93C of the LGA, the Consultation Document contained an audit report from Ernst Young that the consultation document gives effect to the purpose set out in section 93B and the quality of the information and assumptions underlying the forecast information provided in the consultation document.

The consultation on the LTP using the Consultation Document and Supporting Information was be done in accordance with section 83 of the LGA. As part of this, an Engagement Plan was developed to ensure compliance with section 83 and with the key principles of accessibility, transparency and genuine engagement.

Following the adoption of the Consultation, Council held a number of community meetings, a facebook live session, and several have Your Say meetings to discuss LTP and give feedback to the Council. Over the Consultation Period Council received 234 submissions. At the Hearings meeting, Council heard 26 verbal presentations of submissions. On 13 May 2021, Council held a Deliberations meeting to decide on the outcome of the Consultation items and other items raised during submissions.

For the five key initiatives Council consulted, the following was resolved:

1. Planning our wastewater upgrades

2. How do we fund the replacement of our assets

3. Creating a waste free CHB

4. How do we pay for growth

5. Three Waters Bylaws

DISCUSSION

This Long Term Plan is a significant Long Term Plan for Central Hawke’s Bay. It presents an open and transparent view of the reality Council faces and a proposed way forward to address the challenges Council and the community face.

We now know more than we have ever known about the state of our assets, and that for more than two decades, our essential infrastructure has gone without the necessary funding and investment to ensure it is properly maintained. Historic approaches of choosing not to fund renewals and upgrades in order to keep rates artificially low, alongside short term investment decisions, has delivered an unfortunate reality for our communities today.

Many of our assets are at the end of their life, while Central Government legislative standards continue to change and increase. We are now left with failing 100-year-old pipelines, failed wastewater treatment plants - despite major community investment, as well as earthquake prone buildings despite the expectation they had been strengthened. Our reality is that we now require major investment in nearly every aspect of Council’s services.

To address this historic underinvestment, this Long Term Plan increases our debt limits and significant rates increases – not just in the first year of the plan, but through the life of the Long Term Plan Budget 2021-2031. The Long Term Plan 2021 – 2031, is about facing up to the facts.

In building this budget we have trimmed every edge of our cloth and now face a reality where living within our means still requires significant investment to address years of underinvestment and poor investment decisions.

The Long Term Plan does not propose to make any major changes to the levels of service from the previous Long Term Plan, other than adding kerbside recycling collection to Takapau, Otane, Onga Onga, and Tikokino and replacing rubbish bags with wheelie bins from year 3.

The main focus of the Long Term Plan was about continuing the #bigwaterstory programme of Three Water Infrastructure, and in particular treatment of Wastewater.

Officers have included the decisions from the deliberations into the Long Term Plan, which is presented to the Council for consideration and adoption. Those decisions can also be referenced in the minutes (attached) from the Council meeting of the 17th May 2021 where Council made deliberations on the Long Term Plan.

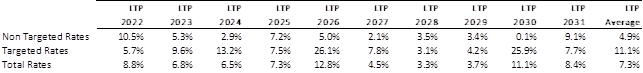

The Long Term Plan includes Rate Increases over the 10 years of the Plan as per the below table.

Section 100(2) of the LGA allows for Council to set projected operating revenue at a different level from operating expenses taking into account achieving and maintaining level of service provision, maintenance of assets and facilities and affordability, that is projecting an unbalanced budget. This is primarily due to not fully funding depreciation as signalled in the financial strategy and balancing the budget sections of the Long Term Plan. The reason for this is Council is undertaking significant catch up in deferred asset renewals and is unable to fully fund depreciation during the course of this Long Term Plan without further financially stressing its ratepayers with even higher rating requirements.

Years 2 to 10 (2023-2031) of the Long Term Plan are showing as being unbalanced. Balanced Budget percentages dip as low as 90%, but lift in the outer years back to 94%. Officers have projected beyond the LTP and forecast that Council will return to being balanced by 2036.

With the increased level of subdivision occurring in the region, and that planned for in the Long Term Plan, it has been identified that Council has an increasing administrative need to process property file splits upon subdivision.

Feedback throughout the LTP process indicated a strong desire for the cost of development to be borne by developers. Splitting of the property file is an integral part of the subdivision process and in line with this premise, a cost that should also be covered by the developer.

Waikato District Council has adopted this approach and applies a fixed fee of $82 for each new lot created. The fees are to be paid at “clearance” stage where all relevant fees including development contributions must be paid prior to the issue of 223/224 certification (which is required to create a title). A fixed fee is the most practical mechanism for cost recovery and avoids the need for a third invoice to be issued, potentially some months after the new titles have been created.

To date, this role has been fulfilled by a part time resource two days a week. For the last four months, an additional day has been added to manage the backlog driven by increased demand/volumes. The current level of development associated with subdivision is expected to continue and the 2021 / 2022 budget has increased this resource to five days a week to manage the workload. A fixed fee per lot would ensure cost recovery in line with Councils adopted Revenue and Financing Policy.

A new fixed fee of $75 per new lot created is proposed to be added to Council’s existing fees and charges schedules which equates to half an hour of the administration charge out rate.

RISK ASSESSMENT and mitigation

The proposed Long Term Plan 2021 – 2031 is a brave step by Council to face up to the facts, and ensure a transparent approach is taken with the community to ensure the facts are known and community are in a position to meaningfully engage.

The proposed Long Term Plan 2021 – 2031 is complex due to the number of big changes and areas of consultation that sit at the core of what matters to community, and the future of Central Hawke’s Bay District Council. Officers have applied both strategic, operational and technical knowledge, and engaged third party independent advice on those matters in the Long Term Plan 2021 – 2031 which have a level of risk associated with it. Both the review of the Development Contributions Policy, development of Asset Management Policies and options associated with Wastewater have had additional scrutiny and both internal and external review. The completion of key outstanding Section 17a Reviews have also added a level of risk mitigation to the development of Activity Management Plans for the next 10 years.

The Long Term Plan was subject to public consultation, and compiled with the public consultation process as set out in the Local Government Act 2002.

The Long Term Plan has been subject to audited by both Ernst Young and the Office of Auditor General, and some components have been subject to legal review. Attached to this report is a copy of the Management Report and Opinion received from auditors. Representatives from Ernst Young will be in attendance at the meeting to speak to this item.

FOUR WELLBEINGS

This Long Term Plan grapples with the aging infrastructure, recovery from Covid-19, the impact of climate change, and rates affordability.

The Long Term Plan proposed here seeks to balance the economic burden of our ratepayers, whilst also facing up to the facts, as a Council, recognising that age, condition, and non-compliance of many of our assets.

It seeks to improve our environmental footprint, be true to our undertakings to remove waste water from our rivers, ensuring that our ratepayers have fit for purpose infrastructure, while also balancing economic wellbeing.

The cultural, social, economic and environmental fabric of Central Hawke’s Bay will be influenced by the decisions made in adopting the Long Term Plan 2021 – 2031. In further leveraging off the vision of Thrive, and the strong foundation of Council’s Environmental Strategy, Economic Action Plan, Social Development Action Plan and Tūhono Mai Tū hono Atu Strategy, the Draft Long Term Plan seeks to carefully balance the holistic wellbeing of Central Hawke’s Bay.

Delegations or authority

Under the Local Government Act 2002 Council must adopt their Long Term Plan. This report seeks that adoption.

sIGNIFICANCE AND ENGAGEMENT

In accordance with the Council's Significance and Engagement Policy, this matter has been assessed as of significance, and as a result of that a robust consultation and engagement process has occurred as per the requirements of the Local Government Act. Council has met its requirements under the Significance and Engagement Policy.

OPTIONS Analysis

Council has two options:

Option 1: Adopt the Long Term Plan 2021-31 in order to finalise the documents for printing and distribution.

Option 2: Resolve not to adopt the Long Term Plan 2021-31 and to give Officers guidance on which amendments were needed and an amended timeframe related to adoption of the Long Term Plan Document would be required.

Recommended Option

This report recommends option number one, Adopt the Long Term Plan Consultation Document 2021-31 and its supporting documents for addressing the matter.

NEXT STEPS

Following the adoption of the Long Term Plan, Council with set the rates for the first year of the Long Term Plan and a report is included within the agenda of the Council meeting for the setting of the rates.

The Chief Financial Officer, in conjunction with the Chief Executive will make any minor amendments and distributed the Long Term Plan as required.

Council Officers will also respond to all the submissions with the outcome of the deliberations and information adopted as part of the LTP.

Should the Council resolve to not adopt the LTP, officers will be require guidance on which amendments are needed and an amended timeframe related to adoption of the LTP would be required.

|

RECOMMENDATION for consideration That having considered all matters raised in the report: a) That Council resolves that the Long Term Plan Budgets for financial years 2-10 (2023-2031) is not a balanced budget because operating revenues are not at a level sufficient to meet operating expenses primarily due to not fully funding depreciation as signalled in the financial strategy and balancing the budget sections of the Long Term Plan. b) That Council resolves that setting an unbalanced budget for years 2-10 (2023-2031) is prudent in terms of section 100 of the Local Government Act 2002 given Council is undertaking significant catch up in deferred asset renewals and is unable to fully fund depreciation during the course of this Long Term Plan without further financially stressing its ratepayers, having had regard to the matters in section 100(2) of the Local Government Act 2002. c) That Council note that Council is undertaking assets renewals at a rate faster than they are depreciating, meaning on average Councils assets are getting younger. This is achieved through a combination of rates and debt funding the renewals. While this strategy increases debt, Council maintains sufficient debt headroom and this temporary funding of renewals through debt does not financially distress the Council. It is Councils intention to revert to fully rate fund depreciation and renewals beyond 2031, thus returning Council to a balanced budget after this date. For these reasons Council believes it is prudent to run unbalanced budgets for 2023-2031. d) That Council adopt the 2021-31 Long Term Plan in accordance with section 93G of the Local Government Act 2002. e) That Council gives delegations to the Chief Executive to make any final edits, including minor changes from the audit process, to the Long Term Plan 2021 – 2031 ahead of formal publication. f) That Council amends its fees and charges schedule for 2021/22 to include a fixed administration fee of per new lot created of $75 GST inclusive entitled “New Property File Creation”.

|

|

17 June 2021 |

6.3 Setting of Rates for 2021/2022

File Number: COU1-1400

Author: Brent Chamberlain, Chief Financial Officer

Authoriser: Monique Davidson, Chief Executive

Attachments: Nil

PURPOSE

The matter for consideration by the Council is the setting of the rates for the 2021/22 financial year. This report is on the basis that Council adopt the Long Term Plan 2021 -2031 as set out in Agenda Item 6.2.

RECOMMENDATION for consideration

That having considered all matters raised in the report:

a) Pursuant to Section 23(1) of the Local Government (Rating) Act 2002, the Central Hawke's Bay District Council resolves to set the rates, due dates and penalties regime for the 2021/22 year.

1. General Rate

A general rate set under section 13 of the Local Government (Rating) Act 2002 for the purposes of providing all or some of the cost of:

• Community leadership, including administration, cost of democracy, community voluntary support grants

• All regulatory activities, including district planning, land use and subdivision consent costs, building control, public health, animal control, and compliance.

• Solid waste

• Parks and reserves, public toilets, theatres and halls, cemeteries, and miscellaneous property costs

For the 2021/22 year, this rate will be based on the rateable capital value of all rateable land within the District on a differential basis as set out below:

|

General Rate Differential Zone |

Differential |

2021/22 Cents per Dollar of Capital Value (including GST) |

|

Waipawa / Waipukurau Central Business District Zone |

1.1 |

0.14455 |

|

Rest of District |

1.0 |

0.13141 |

2. Uniform Annual General Rate

A rate set under section 15 of the Local Government (Rating) Act 2002 on each separately used or inhabited part of a rating unit within the District. See definition below. This rate is for the purpose of providing:

• Economic and social development.

• A portion of the cost of solid waste

• Libraries and swimming facilities

For the 2021/22 year, this rate will be $309.00 (including GST).

Targeted Rates

3. District Land Transport Rate

A rate for the Council's land transport facilities set under section 16 of the Local Government (Rating) Act 2002. This rate is set for the purpose of funding the operation and maintenance of the land transport system.

For the 2021/22 year, this rate will be 0.22172 cents per dollar (including GST) based on the land value of all rateable land in the district.

Separately Used or Inhabited Parts of a Rating Unit

Definition – for the purposes of the Uniform Annual General Charge and the targeted rates above, a separately used or inhabited part of a rating unit is defined as –

A separately used or inhabited part of a rating unit includes any portion inhabited or used by [the owner/a person other than the owner], and who has the right to use or inhabit that portion by virtue of a tenancy, lease, licence, or other agreement.

This definition includes separately used parts, whether or not actually occupied at any time, which are used by the owner for occupation on an occasional or long term basis by someone other than he owner.

Examples of separately used or inhabited parts of a rating unit include:

· For residential rating units, each self-contained household unit is considered a separately used or inhabited part. Each situation is assessed on its merits, but factors considered in determining whether an area is self-contained would include the provision of independent facilities such as cooking/kitchen or bathroom, and its own separate entrance.

· Residential properties, where a separate area is used for the purpose of operating a business, such as a medical or dental practice. The business area is considered a separately used or inhabited part.

These examples are not considered inclusive of all situations.

4. Water Supply Rates

A targeted rate set under section 16 of the Local Government (Rating) Act 2002 for water supply operations of a fixed amount per separately used or inhabited part of a rating unit. The purpose of this rate is to fund water supplies for Otane, Takapau, Waipukurau, Waipawa, Kairakau, Porangahau and Te Paerahi.

The purpose of this rate is to fund the maintenance, operation and capital upgrades of water supplies and treatment in those parts of the District where these systems are provided.

The rate is subject to differentials as follows:

a) a charge of per separately used or inhabited part of a rating unit connected in the Otane, Takapau, Waipukurau, Waipawa, Kairakau, Porangahau, and Te Paerahi Beach communities.

b) a half charge per separately used or inhabited part of a rating unit which is serviceable for the above locations.

For this rate:

· "Connected" means a rating unit to which water is supplied.

· "Serviceable" means a rating unit to which water is not being supplied, but the property it is situated within 100 metres of the water supply.

For the 2021/22 year these rates will be:

|

|

Charge |

Water Rate ( incl GST) |

|

a |

Connected |

$847.95 |

|

b |

Serviceable, not connected |

$423.98 |

5. Metered Water Rates

A targeted rate under section 19 of the Local Government (Rating) Act 2002 per cubic metre of water supplied, as measured by cubic metre, over 300 cubic metres per year. This is applied to water users deemed ‘Extraordinary’ where payment of the Water Supply rate above entitles extraordinary users to the first 300 cubic metres of water without additional charge.

The rate is subject to differentials as follows:

(a) a rate per cubic metre of water, for users consuming below 40,000 cubic metres

(b) A rate per cubic metre of water, for users above 40,000 cubic metres, and where the land use category in the valuation database is not ‘industrial’

(c) a rate of per cubic metre of water, for users consuming above 40,000 cubic metres, and where the land use category in the valuation database is ‘industrial’

For the 2021/22 year these rates will be:

|

|

Volume of water (cubic metres) |

Rate per cubic metre (incl GST) |

|

a |

Below 40,000 |

$2.65 |

|

b |

Above 40,000, non- industrial |

$2.65 |

|

c |

Above 40,000, industrial |

$2.65 |

6. Sewage Rates

A targeted rate set under section 16 of the Local Government (Rating) Act 2002 for the Council's sewage disposal function of fixed amounts in relation to all land in the district to which the Council's sewage disposal service is provided or available, as follows:

(a) a charge per rating unit connected.

(b) a charge per pan within the rating unit, after the first one.

(c) a charge per rating unit which is serviceable.

The rate is subject to differentials as follows:

· "Connected" means the rating unit is connected to a public sewerage system.

· "Serviceable" means the rating unit is not connected to a public sewerage drain but is within 30 metres of such a drain.

· A rating unit used primarily as a residence for one household is treated as not having more than one pan.

· For commercial accommodation providers, each subsequent pan will be rated at 50% of the charge.

· For those Clubs who qualify for a rebate of their General Rates under Council’s Community Contribution and Club Rebate Remission Policy, and who are connected to the sewerage network, each subsequent pan will be rated at 50% of the Sewerage Charge.

The purpose of this rate is to fund the maintenance, operation and capital upgrades of sewerage collection, treatment and disposal systems in those parts of the District where these systems are provided.

For the 2021/22 year these rates will be:

|

|

Charge |

Sewerage Rate (incl GST) |

|

a |

First charge per separately used or inhabited part of a rating unit connected |

$836.59 |

|

b |

Additional charge per pan after the first |

$836.59 |

|

c |

Serviceable, not connected, per separately used or inhabited part of a rating unit |

$418.30 |

|

d |

Additional charge per pan after the first – commercial accommodation provider, qualifying club |

$418.30 |

7. Stormwater Rates

A targeted rate set under section 16 of the Local Government (Rating) Act 2002 for the purpose of funding operations and maintenance, plus improvements and loan charges on the stormwater drainage network as follows:

A uniform targeted rate on the capital value of all rateable land in the Waipukurau, Waipawa, Takapau, and Otane Stormwater Catchment Areas on a differential basis as set out below:

|

Stormwater Catchment Area |

Differential |

2021/22 Cents per Dollar of Capital Value (including GST) |

|

Otane |

0.16 |

0.01399 |

|

Takapau |

0.12 |

0.01049 |

|

Waipawa |

1.00 |

0.08747 |

|

Waipukurau |

1.00 |

0.08747 |

8. Kerbside Recycling Rate

A targeted rate set under section 16 of the Local Government (Rating) Act 2002 for the Council’s collection of household recyclables for Waipukurau, Waipawa, Takapau, Otane, Onga Onga, and Tikokino on each separately used or inhabited part of a rating unit to which the Council provides the service.

For the 2021/22 year this rate will be $88.30 (including GST).

9. Refuse Collection Rate

A targeted rate set under section 16 of the Local Government (Rating) Act 2002 for the collection of household and commercial refuse for Otane, Onga Onga, Takapau, Tikokino, Waipukurau, Waipawa, Porangahau, Te Paerahi, Blackhead Beach, Kairakau, Mangakuri, Aramoana and Pourerere Beach on each separately used or inhabited part of a rating unit to which the Council provides the service.

For the 2021/22 year this rate will be $29.06 (including GST).

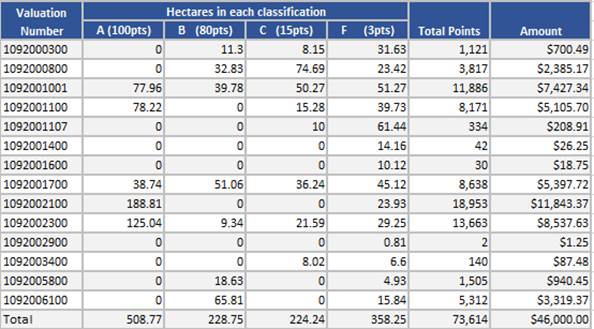

10. Te Aute Drainage Rate

Te Aute Drainage rates are set on all rateable area of rateable property within the designated area subject to a graduated scale for the purpose of funding the operations, loan charges and the repayment of loans for the Te Aute Drainage Scheme area.

The amount required and the classification is set by the Te Aute Drainage Committee.

Each hectare of land in each property is classified according to the susceptibility of that hectare to flooding as follows:

A (100 points), B (80 points), C (15 points), F (3 points), and G (0 points).

The total number of points is 73614. The total amount of funding required each year determines how much each of these points are worth. In this way, the total amount required is apportioned on a pro rata basis using the weightings on each hectare.

The total amount of funding required for 2021/22 is $46,000

The amount per point is 62.48811 cents including GST.

The Te Aute drainage scheme area is defined by reference to the classification list establishing the graduated scale.

Approach to Rating

Rates are set and assessed under the Local Government (Rating) Act 2002 on all rateable rating units on the value of the land and improvements as supplied by Quotable Value New Zealand Limited. . The last rating revaluation was carried out in September 2018 and is effective from 1 July 2019.

The objectives of the council's rating policy is to:

I. spread the incidence of rates as fairly as possible

II. be consistent in charging rates

III. ensure all ratepayers pay their fair share for council services

IV. provide the income needed to meet the council’s goals.

The Central Hawke’s Bay District Council rating system provides for all user charges and other income to be taken into account first, with the rates providing the balance needed to meet the council's objectives.

Rating Base

The rating base will be the database determined by the contracted rating service provider. Because this database is constantly changing due to change of ownership, subdivision, regular revaluations, change of status from rateable to non-rateable (and reverse), the rating base is not described in detail in this policy.

Due Dates for Rate Payments

Pursuant to Section 24 of the Local Government (Rating) Act 2002, the following dates are proposed to apply for assessing the amount of each instalment of rates excluding metered water rates for the year 1 July 2021 to 30 June 2022. Each instalment will be assessed in four equal amounts, rounded.

|

Instalment number |

Instalment Start Date |

Last day of payment without additional charge |

Penalty date |

|

1 |

1 July 2021 |

20 August 2021 |

21 August 2021 |

|

2 |

1 October 2021 |

20 November 2021 |

21 November 2021 |

|

3 |

1 January 2022 |

20 February 2022 |

21 February 2022 |

|

4 |

1 April 2022 |

20 May 2022 |

21 May 2022 |

Due Dates for Metered Water Rates

Pursuant to Section 24 of the Local Government (Rating) Act 2002, the following dates are proposed to apply for assessing the amount of metered water rates for the year 1 July 2021 to 30 June 2022. The assessment is applied to water users after the first 300 cubic metres of water without additional charge has been used as part of the Water Supply Rate.

|

Area/Users |

Water Meters read during |

Last day of payment |

|

Commercial/Large Users |

Monthly |

20th month following |

|

Waipawa / Waipukurau |

September, December, March, June |

20th month following |

|

Takapau / Otane |

August, November, February, April |

20th month following |

|

Kairakau / Porangahau / Te Paerahi |

July, October, January, April |

20th month following |

Penalty Charges

(Additional Charges on Unpaid Rates)

Pursuant to Section 58(1)(a) of the Local Government (Rating) Act 2002, an additional charge of 6% will be added on the penalty date above, to all amounts remaining unpaid for each instalment excluding metered water rates.

Pursuant to Section 58(1)(b) of the Local Government (Rating) Act, a further additional charge of 6% will be added on 1 July 2021 to the amount of rates assessed in previous financial years and remaining unpaid as at 30 June 2022 (Section 58(1)(b)) excluding metered water rates.

Targeted rates for metered water supply will be invoiced separately from other rates invoices. A 6% penalty will be added to any part of the water rates that remain unpaid by the due date as shown in the table above as provided for in Section 57 and 58(1)(a) of the Local Government (Rating) Act 2002.

EXECUTIVE SUMMARY

This report is the final step in the process of being able to set the rates for the 2021/22 financial year following the adoption of the Long Term Plan 2021 - 2031. The rates included in the report are part of the Funding Impact Statement that is included in the Long Term Plan for the 2021/22 financial year.

BACKGROUND

Council is required to resolve to set the rates, due dates and penalties regime for the 2021/22 year. The rates required by Council to be able to meet the requirements of the purpose of Local Government are part of the development of Long Term Plan and are set out within the attached Funding Impact Statement within the Long Term Plan. Following the adoption of the Long Term Plan, Council is required to set rates in accordance with Funding Impact Statement and Section 23 of Local Government (Rating) Act 2002.

DISCUSSION

Once Council has set its Long Term Plan for the year it knows what it expects its cost structure to be, and therefore what income it needs from rates and fees and charges to recover these costs.

To ensure that the appropriate level of rates are levied, it must set appropriate “Rate Factors” that will generate the required level of rates revenue.

For example, Land Transport is rated based on “Land Value” and Central Hawkes Bay District has $3.6 billion of land value across its District. The Rates required to cover the Land Transport activity is $8.0m, so by dividing one into the other, Council is required to rate $0.0022172 for every dollar of Land Value a property has. This is its Rate Factor.

So working through an example, a house in Waipukurau with a Land Value of $100,000 will pay $221.72 in Land Transport Rates.

On Wednesday the 31st May, Council Officers undertook a rates strike based on the rating database at that point in time, to set the Rates Factors for 2021/22 that would generate the revenue required to match the 2021/22 Long Term Plan expectations.

The full list of rates factors are:

|

Rates Type |

2021/22 Factor |

2021/22 Factor |

% Change |

|

General Rate |

$0.10890 |

$0.13141 |

20.67% |

|

Land Transport |

$0.21871 |

$0.22172 |

1.38% |

|

Refuse Collection |

$30.18 |

$29.06 |

(3.71%) |

|

Sewerage |

$826.70 |

$836.59 |

1.20% |

|

Stormwater |

$0.09105 |

$0.08747 |

(3.93%) |

|

Water Supply |

$789.33 |

$847.95 |

7.43% |

|

Water Supply by Meter |

$2.65 |

$2.65 |

0.00% |

|

Recycling |

$99.84 |

$88.30 |

(11.56%) |

|

UAGC |

$290.53 |

$309.00 |

6.36% |

|

Te Aute Drainage |

$0.23433 |

$0.62488 |

166.67% |

|

Rates Penalty |

6% |

6% |

0% |

Historically Central Hawkes Bay District Council has only ever applied rates penalties to non-volumetric rates (that is they have excluded metered water charges). This is not the case for other some other Councils across New Zealand, and Officers are recommending that Central Hawkes Bay District Council introduces penalties on overdue water meter charges in the same manner as other rates types.

RISK ASSESMENT AND MITIGATION

Setting of the rates is a requirement of the LGA and the Section 23 of Local Government (Rating) Act 2002. Council is required to set the rates in accordance with the Act to ensure they are lawful and can be collected from ratepayers. The nature of the resolution recommended to Council is aligned with legal advice.

FOUR WELLBEINGS

Rates funding allows the Council to deliver the services included in the Long Term Plan which are based on the Community Outcomes included in the plan. The rates proposed to be set are consistent with the Long Term Plan 2021/22, therefore the decision before Council enables the Council to fund and finance the programmes and services which will in turn support the fostering of community wellbeing.

Delegations or authority

Council is required to set rates based on the Long Term Plan and in accordance with Section 23 of Local Government (Rating) Act 2002.This is a duty that only Council has authority to make and is unable to delegate.

sIGNIFICANCE AND ENGAGEMENT

In accordance with the Council's Significance and Engagement Policy, this matter has been assessed as being critical to the financial management of the Council, however the decision before Council to strike the rates does not trigger significance in itself.

OPTIONS Analysis

Option 1

Pursuant to Section 23(1) of the Local Government (Rating) Act 2002, the Central Hawke's Bay District Council resolves to set the rates, due dates and penalties regime for the 2021/22 year.

Option 2

Council resolves to not set the rates, due dates and penalties regime for the 2021/22 year and to give Officers guidance on which amendments are needed and an amended timeframe related to setting of rates would be required. Any amendments are likely to result in amendments to the Long Term Plan, which will require further guidance and instruction from Office of the Auditor General.

Setting of rates is key for the service provision and the financial management and funding of Council. Following the adoption of the Long Term Plan 2021 -2031, this allows the Council to collect the rates required to deliver the service of Council for 2021/22. Not setting the rates would put Council at financial risk.

Recommended Option

This report recommends option number one “setting the rates” for addressing the matter.

NEXT STEPS

Following the setting of Rates, Council Officers will strike the rates within the Council rating system and following 1st July, the first rates assessment will be sent to ratepayers.

|

RECOMMENDATION for consideration That having considered all matters raised in the report: a) Pursuant to Section 23(1) of the Local Government (Rating) Act 2002, the Central Hawke's Bay District Council resolves to set the rates, due dates and penalties regime for the 2021/22 year.

|

|

17 June 2021 |

|

Recommendation THAT the next meeting of the Central Hawke's Bay District Council be held on 24 June 2021. |