I hereby give notice that a Meeting of Council will be

held on:

|

Date:

|

Thursday, 20 June 2019

|

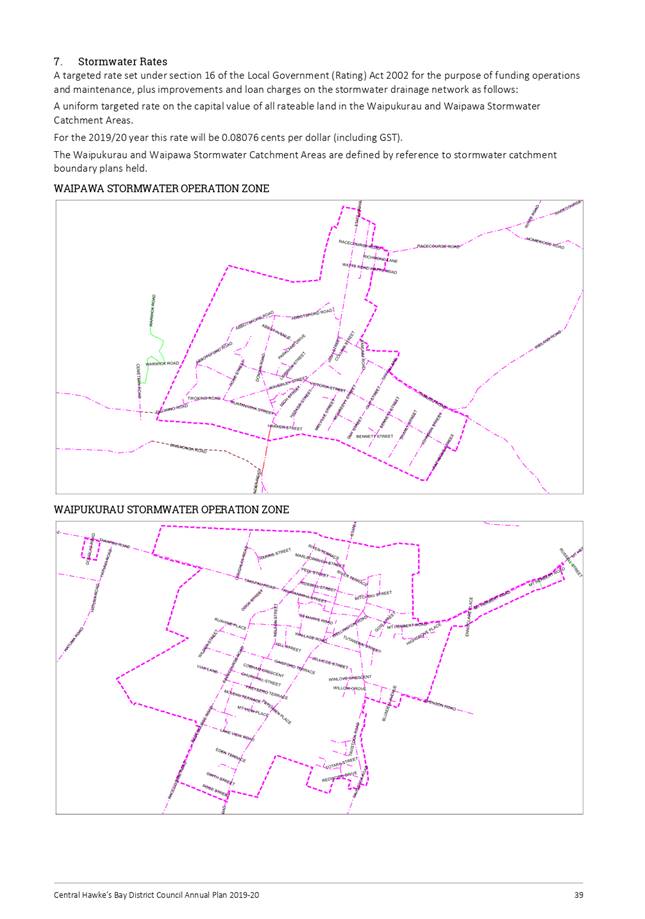

|

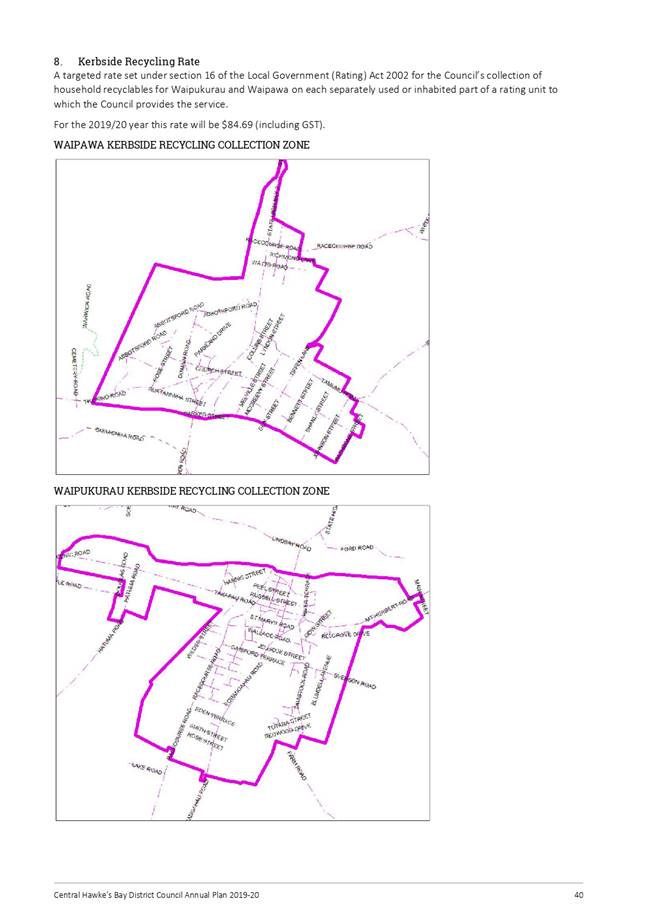

Time:

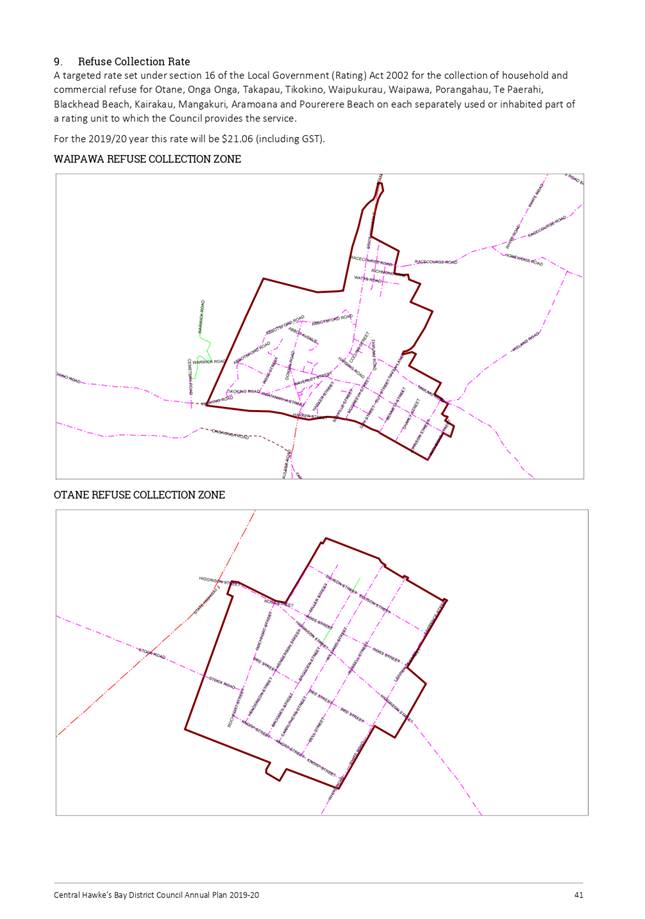

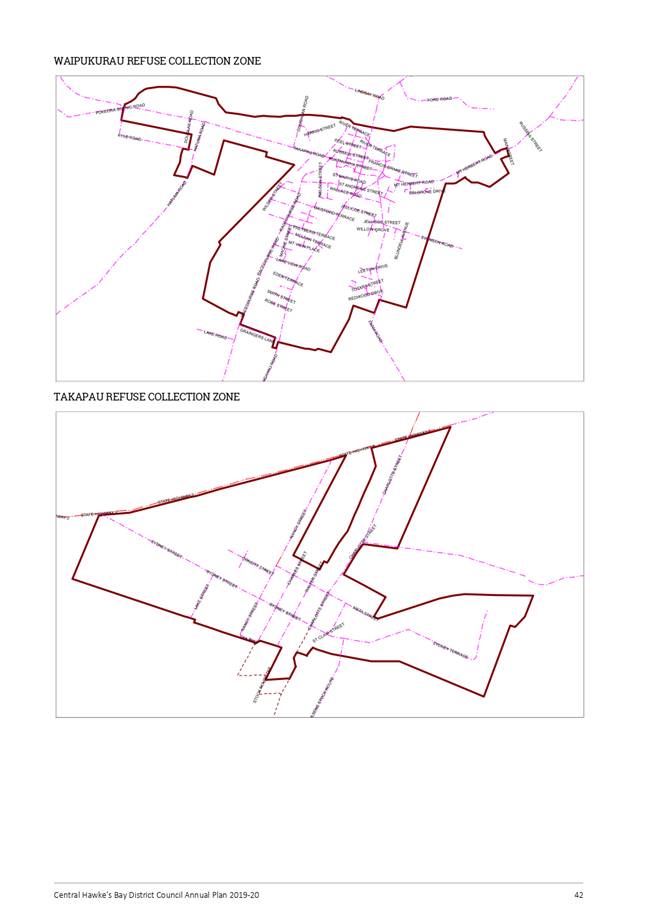

|

at the conclusion of the public forum which

commences at 9am

|

|

Location:

|

Council Chamber

28-32 Ruataniwha Street

Waipawa

|

AGENDA

Council Meeting

20 June 2019

Our vision for Central Hawke’s Bay is a proud and prosperous

district made up of strong communities and connected people who respect and

protect our environment and celebrate our beautiful part of New Zealand.

Monique Davidson

Chief Executive

“We dedicate ourselves to the service of the

District of

Central Hawke’s Bay/Tamatea and its people.

We ask for God’s help

to listen to all

to serve all

and to lead wisely.

Amen.”

2 Apologies

3 Declarations

of Conflicts of Interest

4 Standing

Orders

|

RECOMMENDATION

THAT the following standing orders are

suspended for the duration of the meeting:

20.2 Time limits on speakers

20.5 Members may speak only once

20.6 Limits on number of speakers

And that Option C under section 21

General procedures for speaking and moving motions be used for the meeting.

Standing orders are recommended to be

suspended to enable members to engage in discussion in a free and frank

manner.

|

5 Confirmation

of Minutes

Ordinary Council

Meeting - 23 May 2019

Extraordinary Council

Meeting - 30 May 2019

Council Meeting Agenda 20

June 2019

MINUTES OF Central Hawkes Bay

District Council

Council Meeting

HELD AT THE CHB Municipal Theatre, 18

Kenilworth St, Waipawa

ON Thursday, 23 May 2019 AT 9.00am

PRESENT: Mayor Alex Walker

Cr Ian Sharp (Deputy

Mayor)

Cr Shelley

Burne-Field

Cr Kelly Annand

Cr Tim Aitken

Cr Tim Chote

Cr Gerard Minehan

Cr Brent Muggeridge

Cr David Tennent

Dr Roger Maaka

IN ATTENDANCE: Joshua Lloyd (Group

Manager, Community Infrastructure and Development)

Bronda Smith (Group

Manager, Corporate Support and Services)

Doug Tate (Group

Manager, Customer and Community Partnerships)

Nicola Bousfield

(People and Capability Manager)

Leigh Collecutt (Governance and Support Officer)

Kim Parker (Communications Manager)

Kyra Low (Finance Manager)

6 Members of the public were in attendance

at the commencement of the meeting. A number of people came and went

throughout the meeting.

1 Prayer

Dr Maaka opened the meeting with a karakia

2 Apologies

Cr Chote was previously granted a leave of

absence at the Council meeting held 10th April. Cr Chote was

briefly in attendance at the meeting as an observer.

3 Declarations

of Conflicts of Interest

No conflicts of interest were declared.

4 Standing

Orders

|

Resolved: 19.27

Moved: Cr

Ian Sharp

Seconded: Cr

Kelly Annand

THAT the following standing orders are

suspended for the duration of the meeting:

20.2 Time limits on speakers

20.5 Members may speak only once

20.6 Limits on number of speakers

And that Option C under section 21

General procedures for speaking and moving motions be used for the meeting.

Standing orders are recommended to be

suspended to enable members to engage in discussion in a free and frank

manner.

Carried

|

Mayor Walker provided a reminder of

standing orders around speaking rights for members of the public and the rules

of debate for Councillors.

5 Confirmation

of Minutes

|

Resolved: 19.28

Moved: Cr

Shelley Burne-Field

Seconded: Cr

Gerard Minehan

That the minutes of the Ordinary Council

Meeting held on 9 May 2019 as circulated, be confirmed as true and correct.

Carried

|

6 Reports

from Committees

Nil

7 Report

Section

|

7.1 Deliberations

- Annual Plan 2019/2020 - Management Overview

|

|

PURPOSE

The purpose of this report is to present to Council for

deliberation a management overview and issues identified since the adoption

of the Annual Plan Consultation Document and Supporting Information.

|

|

Recommendation

That having considered all matters raised in the

report:

a) That

Council note the changes requested to the 2019/2020 Annual Plan budget,

which will be included in the Annual Plan 2019/2020 that is presented for

adoption on 20th June 2019.

Motion

Moved: Cr David

Tennent

Seconded: Cr

Ian Sharp

That Council

note the changes requested to the 2019/2020 Annual Plan budget, and that

topics 2, 3, 5 and 6 are approved with the decision on topic 1 and topic 4

to be deferred to a further meeting between now and 20th June

and topic 2 is funded over ten years rather than five.

CARRIED

Amendment

Moved: Cr Shelley

Burne-Field

Seconded: Cr

Gerard Minehan

That topic

two for LiDAR funding be reduced to $50,000.

In

Favour: Crs Shelley Burne-Field and

Gerard Minehan

Against: Crs

Alex Walker, Ian Sharp, Kelly Annand, Tim Aitken, Brent Muggeridge and

David Tennent

lost 2/6

|

|

Cr Tennent indicated his concern about the significant increases

being proposed and asked that each topic in the report be covered separately to

ensure clarity.

Topic One: Three Waters compliance

Cr Annand sought clarification about how this would fit in with the

regional and national three waters reviews. Officers confirmed that the

final report for the regional 3 waters review would be presented to regional

Chief Executives the week following the meeting and at that stage would be in a

better position to update elected members.

Cr Annand sought clarification about what the consequences would be if

the Council waited for an outcome from these reviews. Officers confirmed

that there was a potential risk of prosecution and enforcement for not meeting

the required standards for water compliance. It was also confirmed that

it was necessary to prepare budgets appropriately given the length of time the

programme would likely take to come to a resolution.

Cr Minehan asked whether other Councils around the country

found themselves in a similar situation

Officers confirmed that this was a national issue.

Cr Muggeridge sought clarification about whether the Council could

defer any capex programmes to soften the rates impact.

Officers indicated that this was high risk because there had been a

number of projects previously deferred which needed doing. It was also

raised that there had been clear feedback from the community that progressing

water projects was a priority.

Cr Sharp asked whether the Council could advocate to Central

Government to consider the impact continued regulation has on rates.

Mrs Davidson acknowledged that the reason the reform programme was

put in place was to address these affordability issues.

Topic two LiDAR:

Cr Sharp sought clarification on how funding was being split for

this project.

It was confirmed that Hawke’s Bay Regional Council had set

$300,000 in their LTP budget for year two. Central Hawke’s Bay and

Wairoa District Councils were to pay $100,000 each and $550,000 was to be

shared between Napier City and Hastings District Councils.

Cr Tennent raised concerns about the regional split amounts.

Cr Sharp asked if the rating impact could be reduced by extending

the 5 year loan to a 20 year loan given benefit would continue into

future. Mrs Smith indicated that 10 years would be possible but that 20

years would be too long a period of time to extend the loan for.

Cr Aitken sought clarification about whether any cost benefit

analysis had been done.

Officers confirmed that there would be significant benefit including

improved asset management modelling.

Topic three: Elected Member remuneration

Cr Minehan sought clarification about whether it was a legal

requirement to increase elected members’ remuneration amounts.

Officers confirmed that it was a requirement through the Remuneration Authority

Determination and that the organisation was legally required to pay gazetted

amounts.

Topic four: Community Trust Request for Funding

Cr Aitken sought clarification about why the trust could not seek

other ways of increasing its income.

Cr Sharp highlighted his support for the facility and sought

clarification about whether the insurance included the stadium or just the

pool? It was confirmed that the insurance was only for the pool complex.

Cr Burne-Field sought clarification about whether other funding

opportunities had been explored and whether the Council could offer insurance

for a lower price.

Officers confirmed that the trust currently had no other funding

avenues available to meet these costs. Mrs Smith highlighted that the

trust had previously been part of Council’s insurance package but had

sought to get insurance independently.

Cr Sharp spoke to the motion that he would like to see some

increased transparency about the running of the community trust and the way it

functions.

Cr Aitken also requested that additional information was provided

regarding the CHB Community Trust’s finances.

Topic five: Addressing Deficiencies in Council’s

Emergency Management Preparedness

Cr Aitken sought clarification about whether alternative technology

was available which would suit the purpose. Officers confirmed that the

cost of alternative technology would not be viable.

Mrs Davidson also highlighted that this preparedness was necessary

to ensure business continuity to run the Emergency Operations Centre and still

be able to operate the Council’s business as usual.

Cr Burne-Field asked where the existing 27 radios in the district

were located and raised concern that there were only 7 across a wide area.

Officers confirmed that analysis had been undertaken which took into account

the risk of losing communication with key areas of the district.

Cr Annand sought clarification about regional versus district

emergency funding.

Officers confirmed that service delivery was a regional function and

cost but that local Councils are still legally required to provide base

infrastructure.

Cr Sharp sought clarification about what the ongoing servicing costs

be to keep up to date. Officers confirmed that this had already been

budgeted for.

Topic Six Building Control Fees and Charges

Cr Tennent sought clarification about whether recovery rates would

change for consents.

Officers confirmed that they would not change. However it was

noted that revenue targets were currently under budget and that the proposed

changes to the fees schedule could assist in meeting those targets.

Cr Burne-Field noted her objection to the inclusion of Topic 6 in

the motion.

Further discussion relating to motion:

Officers provided advice around what the implications would be of

deferring topic 1 – water compliance and topic 4 – CHB Community

trust funding in terms of striking the rates for the annual plan. In

order for Councillors to receive the information needed to make a decision on

these items an extraordinary meeting would need to be called before the

adoption date of 20th June.

Meeting suspended 10.44am for morning tea

Meeting reconvened at 11.00am

|

7.2 Deliberations

- Annual Plan 2019/20 - #the even bigger water story

|

|

PURPOSE

The purpose of this report is to present to Council the

submissions received on the Annual Plan consultation in relation to whether

the Council should provide a suspensory loan to Water Holdings CHB for the

purpose of exploring and assessing workable options to achieve water

security.

|

|

Recommendation

That, having considered all matters raised in the

report that Council deliberate to determine their preferred option.

Motion

Moved: Mayor Alex

Walker

Seconded: Cr

Tim Aitken

That security of access to water is a significant issue

for Central Hawke’s Bay and that water storage is an important part

of a package of solutions.

CARRIED

|

|

|

Motion

Moved: Cr

Brent Muggeridge

Seconded: Cr

Tim Aitken

That Council agree in principle to provide a

suspensory loan to Water Holdings CHB Limited of up to $250,000.00

That the chief executive be delegated authority to negotiate a

draft services agreement with Water Holdings CHB limited which includes key

terms and conditions to bring back to council for further consideration.

That the draft services agreement which

includes key terms and conditions include provisions for a staged approach to

the funding with a high level of checks and balances.

In Favour: Crs

Tim Aitken and Brent Muggeridge

Against: Crs

Alex Walker, Ian Sharp, Shelley Burne-Field, Kelly Annand, Gerard Minehan and

David Tennent

MOTION

LOST

Motion

Moved: Mayor

Alex Walker

Seconded: Cr

David Tennent

a) That $250k from the rural

reserve fund is tagged for supporting water security initiatives in Central

Hawke’s Bay.

b) That council supports a

collaborative approach at both a local and regional level for development of

water security initiatives.

c) That council requests staff

bring back a framework which includes further information on the potential

role of Central Hawke’s Bay District Council together with Water

Holdings CHB, HBRC and the Tukituki taskforce, for understanding issues of

water security and creating a local package of solutions.

CARRIED

|

Cr Muggeridge highlighted that the $250,000

requested was money for research and development of water storage solutions,

not to build a dam. He noted that Water Holdings CHB was simply a vehicle

for a water security conversation to take place.

Cr Aitken highlighted the benefit of

exploring options available and that a public/private partnership opportunity

would be needed to do this. Cr Aitken was supportive of the Chief

Executive coming back with further reporting and the expected funding

milestones which would need to be demonstrated.

Cr Tennent agreed with the initial motion

from Mayor Walker about the impact of water security but raised concern with

the potential of revisiting the dam.

Mayor Walker raised that she would not

support the motion from Cr Muggeridge because of the need for a wider

conversation about water security and how it fits with other initiatives in the

district.

Mayor Walker provided an additional motion.

Speaking in support of this motion, Mayor

Walker highlighted that it was important to provide a funding platform which

would help conversations in the district to take place about what community

priorities are. Mayor Walker raised that it was vital to address wide

community outcomes with the funding, not commercial outcomes. She noted

that there was commitment and passion about water in the community and felt it

was important the community should have an opportunity to be considered and

heard.

In seconding the motion, Cr Tennent raised

that this was an excellent way forward and acknowledged submitters who were

concerned about tying all funds in with one entity. Cr Tennent raised the

importance of the Council demonstrating its desire to do something to address

the water security issue. He also acknowledged Water Holdings CHB and

wanted to ensure they would be involved in ongoing discussions.

Cr Aitken and Cr Minehan spoke in support

of the motion given the broader view to explore other options.

Cr Burne-Field highlighted the importance

of building trust back in the community, given how divisive the issue of water

storage issue has been. Cr Burne-Field raised some concern over the

dollar amount still being high but was in support of the motion.

Cr Sharp supported the motion and

acknowledged Water Holdings CHB for the role they had played in initiating the

conversation.

Cr Annand supported a collaborative

approach and raised the importance of maintaining momentum and action.

Mayor Walker acknowledged the importance of

community healing and about needing to move forward without being on opposite

sides of equation. Mayor Walker also agreed with Cr Annand that there was

a need to be focussed to ensure some urgency around developing a framework.

Mayor Walker recognised of the value of the

leadership Water Holdings CHB had demonstrated by purchasing the IP for the

benefit of the community. She highlighted that they were an important

partner in the framework but in a wider context.

Mayor Walker also thanked submitters for

their valuable input.

|

3 Deliberations

- Annual Plan 2019/20 - Revenue and Financing Policy

|

|

PURPOSE

The purpose of this report is to present to Council for

deliberation of the submissions received on the Annual Plan consultation in relation

to proposed minor variations to the Council’s Revenue and Financing

Policy.

|

|

Resolved: 19.29

Moved: Cr Ian Sharp

Seconded: Cr

David Tennent

That, having considered all matters raised in the

report:

a) That

Council adopt the Revenue and Financing Policy as proposed.

Carried

|

|

Cr Sharp raised the point that the variations needed to happen,

otherwise the Council would be going over the rate affordability index for some

people.

Cr Tennent highlighted that this was a pragmatic option, though

noting some concerns with spreading activities to the general rate from the

UAGC.

Cr Aitken spoke against the motion. His concern was that the

governance and leadership activity should be allocated to the UAGC.

Mayor Walker spoke in support of the motion, given the current

crisis in the affordable property market.

Cr Sharp raised that this was the only fair system at this time.

|

7.4 Deliberations

- Annual Plan 2019/20 - Finance

|

|

PURPOSE

The purpose of this report is to present to Council the submissions

received on the Annual Plan consultation in relation to Finance.

|

|

RecommendationS

That

having considered all matters raised in the report:

Motion

Moved: Cr Ian Sharp

Seconded: Cr

Shelley Burne-Field

That funding

for Ongaonga Historical Society is increased to $4,000 each year as a grant

for mowing and this year’s increase is funded out of interest from

the Rural Reserve Fund.

CARRIED

Motion

Moved: Cr David

Tennent

Seconded: Cr

Brent Muggeridge

That Council

continues to invest in our facilities in CHB to allow us to act as a feeder

to the Regional Programme but are fully in support of the trust’s

initiatives.

CARRIED

Motion

Moved: Mayor Alex

Walker

Seconded: Cr

Tim Aitken

That Biodiversity

Hawke’s Bay is granted funding of $10,000 for 2019/20 year to

contribute to the biodiversity endowment fund and that funding comes from

rural fire reserve fund.

CARRIED

|

|

Cr Sharp spoke in support of providing additional funding to

Ongaonga Historical society as long as there was no rates impact and moved that

this funding come from the rural reserve fund.

Cr Tennent raised that the Council could not afford to provide

$20,000 to the Hawke’s Bay Community Fitness Trust at this time but fully

supported the objectives of the facility.

Mayor Walker agreed that the facility is an outstanding investment

in the health and wellbeing of people of Hawke’s Bay, but that the

council needed to focus on Central Hawke’s Bay facilities at this

time.

Cr Annand acknowledged Sir Graeme’s commitment to making the

facility happen.

|

7.5 Deliberations

- Annual Plan 2019/20 - Environment

|

|

PURPOSE

The purpose of this report is to present to Council the

submissions received on the Annual Plan consultation in relation to

Environmental matters.

|

|

Resolved: 19.30

Moved: Cr Ian Sharp

Seconded: Cr

Brent Muggeridge

That having considered all matters raised in the

report;

a) That

submitters’ comments are noted, with no specific recommendation

necessary with regard to the Annual Plan 2019/2020.

Carried

|

|

Cr Tennent highlighted that maintenance of rural roads is done on a

request for service basis and sought that this was communicated to the

community. He raised that Council can’t afford to do it all and

have to prioritise wisely.

Cr Muggeridge sought clarification about whether people received

individual communications around maintenance of rural roads.

Officers confirmed that this was the case but also considered that

there was an opportunity to do it better.

|

7.6 Deliberations

- Annual Plan 2019/20 - Community

|

|

PURPOSE

The purpose of this report is to present to Council the submissions

received on the Annual Plan consultation in relation to Community activities.

|

|

Resolved: 19.31

Moved: Cr Ian Sharp

Seconded: Cr

Gerard Minehan

That having considered all matters raised in the

report:

a) That

the provision of a new toilet at Whangaehu be considered as part of the Long

Term Plan 2021-31;

Carried

|

|

Resolved: 19.32

Moved: Cr Ian Sharp

Seconded: Cr

Shelley Burne-Field

That having considered all matters raised in the

report:

a) That

the points raised in submission 123 for the landscaping of Abercrombie

Street, Porangahau, are considered as part the community plan, for

consideration as part of the 2021-31 Long Term Plan review;

Carried

|

|

Resolved: 19.33

Moved: Cr Tim Aitken

Seconded: Cr

Brent Muggeridge

That having considered all matters raised in the

report:

a) That

Officers work with the Porangahau Community as part of their community

planning process to determine the most appropriate location for a

netball/tennis court in Porangahau, for consideration as part of the Annual

Plan 2020/21 process;

Carried

|

|

Resolved: 19.34

Moved: Cr Ian Sharp

Seconded: Cr

Kelly Annand

That having considered all matters raised in the

report:

a) That

Officers work with Forest and Bird to understand local priorities and

opportunities for Lindsay bush for consideration as part of the Long Term

Plan 2021-31

Carried

|

|

|

|

7.7 Deliberations

- Annual Plan 2019/20 - The Establishment of a Disaster Relief Fund Trust

|

|

PURPOSE

The purpose of this report is to present to Council for

deliberation the submissions received on the Annual Plan consultation in

relation to the proposal to establish a Disaster Relief Fund Trust.

|

|

Resolved: 19.35

Moved: Mayor Alex

Walker

Seconded: Cr

Kelly Annand

That having considered all matters raised in the

report:

a) Council

approves the establishment of a Disaster Relief Fund Trust as a Council

Controlled Organisation under the Local Government Act.

Carried

|

|

Meeting was suspended at 12.52pm for lunch

Meeting reconvened at 1.34pm

|

7.8 Deliberations

- Annual Plan 2019/20 - Draft Environmental and Sustainability Strategy

|

|

PURPOSE

The purpose of this report is to present to Council the

submissions received on the Annual Plan consultation in relation to the draft

Environmental and Sustainability Strategy.

|

|

Resolved: 19.36

Moved: Cr Gerard

Minehan

Seconded: Cr

Kelly Annand

That, having considered all matters raised in the

report;

a) That Council adopt the

Environmental and Sustainability Strategy and

b) That Council consider future

funding requirements to implement the Environmental and Sustainability

Strategy as part of the Annual Plan 2020/21

Carried

|

|

Cr Minehan highlighted that the strategy aligned very well with the

values of the solid waste minimisation reference group.

Cr Sharp congratulated Council in the development of the strategy

and was pleased that Council could use the document as a lens for further

policy development.

Mayor Walker highlighted that the strategy helped the Council to

articulate its role in managing its impact on the environment.

|

7.9 Deliberations

- Annual Plan 2019/20 - Governance and Leadership

|

|

PURPOSE

The purpose of this report is to present to Council

submissions received in relation to Governance and Leadership activities

|

|

Resolved: 19.37

Moved: Cr Shelley Burne-Field

Seconded: Cr

Gerard Minehan

That

having considered all matters raised in the report;

a) That submitters’

comments are noted, with no specific recommendation necessary with regard

to the Annual Plan 2019/20.

Carried

|

|

Items 7.11 and 7.12 were considered prior to item 7.10

|

7.10 Quarterly

Financial Reporting for March 2019

|

|

PURPOSE

Provide Council with a summary of

Council's third quarter financial performance for the 2018/19 financial year.

|

|

Resolved: 19.38

Moved: Cr

David Tennent

Seconded: Cr

Tim Aitken

That,

having considered all matters raised in the report, the report on Council's

third quarter financial performance for the 2018/19 financial year be noted.

Carried

|

|

7.11 Deliberations

- Annual Plan 2019/20 - Proposed Dog Pound

|

|

PURPOSE

The purpose of this report is to present to Council for

deliberation the proposed options for the issues identified since the

adoption of the Annual Plan Consultation Document and Supporting Information

in regards to the development of the Dog Pound for Central Hawke’s Bay.

|

|

Resolved: 19.39

Moved: Cr David Tennent

Seconded: Cr Tim

Aitken

That having considered all

matters raised in the report:

a) That

Council approve additional capital expenditure of $297,000 in the 2019/20 for

the development of a pound facility in Central Hawke’s Bay; and

further:

b) That

a report is brought back to Council on the proposed new pound, prior to any

capital expenditure commencing.

In

Favour: Crs Alex Walker, Ian Sharp,

Tim Aitken, Gerard Minehan and David Tennent

Against: Crs

Shelley Burne-Field and Kelly Annand

Abstained: Cr

Brent Muggeridge

carried 5/2

Carried

|

Mayor Walker Sought clarification about what the rates impact would

be to develop a pound facility.

Officers confirmed that they were proposing no rates increase.

The first year would be debt funded and subsequent years be recovered in Animal

Control Fees and Charges.

Cr Burne-Field sought clarification about whether we had been asked

to vacate the current pound.

Officers confirmed that notice had been given that no ongoing

provisions would be made for a Council pound facility.

Cr Aitken sought clarification about numbers of dogs impounded each

year.

Officers confirmed that this was 25 in the 2nd quarter of

the financial year.

Cr Tennent moved the recommendation and spoke in support of the

motion, though raised concerns that MPI and the SPCA needed to be made aware of

the rating impact and the cost to the community.

Cr Aitken seconded the motion but highlighted that he did so

reluctantly. Cr Aitken and Cr Sharp both raised concerns about the

requirements from the Ministry of Primary Industries (MPI) without

consideration given for how to fund them.

Cr Burne-Field asked whether another report could come back about

what the facility would actually look like and requested that a holding

facility was considered rather than full of facility.

Cr Minehan – agreed with Cr Burne-Field regarding a potential

holding facility.

Mayor Walker and Cr Annand sought clarification from officers about

what the implications would be for the Council if funding was not

allocated. Officers confirmed there were potential fines and exposure to

Council being prosecuted. It was raised that the reason for raising the issue

at this time, was to prevent further implications for next year’s Annual

Plan.

Cr Annand spoke against the motion and requested that officers work

with SPCA to understand their strategic direction for Central Hawke’s

Bay.

Cr Sharp noted that Council’s decision had been forced by new

regulations and that the Council could not be exposed to legal action so he was

forced to support the recommendation but wanted his objection noted.

Cr Aitken requested that the Mayor and Chief Executive write a

letter to SPCA and MPI stating the Council’s objections to the new

regulations.

|

7.12 Implementation

of Dust Suppression Policy

|

|

PURPOSE

The purpose of the report is for Council to consider the

options to expedite the implementation of the Dust Suppression Policy.

|

|

Resolved: 19.40

Moved: Cr Shelley

Burne-Field

Seconded: Cr

Brent Muggeridge

That, having considered all matters raised in the

report that Council deliberate to determine their preferred option.

Motion

Moved: Cr Shelley

Burne-Field

Seconded: Cr

Brent Muggeridge

a) That Council approve targeting external funding through the creation

of business cases to support investment in sealing to control dust by

reallocating $50,000 from existing carry forward budgets

b) That

Council reprioritise $200,000 of the existing Land Transport budget/work

programme to contribute to sealing of roads to control dust if required.

Carried

|

Cr Tennent sought clarification about whether NZTA would look at

funding sealing of a road based on the number of houses the road services.

Officers confirmed that the NZTA criteria for dust suppression was

prescriptive and had previously not applied to particular roads in the district

needing to be sealed. However it was noted that if business cases were prepared

that there could be potential for some roads to be considered in the future.

Mayor Walker sought clarification about what the implications might

be if Council were to reprioritise land transport funds. Officers

confirmed that this could mean that some work would be carried over to next

year.

Cr Burne-Field moved both option 2 and option 4 from the

officer’s report.

Cr Muggeridge was in support of motion as it provided some ability

to progress a longstanding issue.

Cr Tennent raised concerns with reprioritising land transport budgets

given that some submitters to the Annual Plan had raised concerns about the

condition of rural roads.

Mayor Walker raised that the Long Term Plan may need to happen

earlier than planned due to Wastewater requirements. Mayor Walker

indicated that this could provide scope to clearly outline expected levels of

service for land transport.

8 Chief

Executive Report

Nil

9 Public

Excluded Business

Nil

10 Date of Next

Meeting

|

Resolved: 19.1

Moved: Mayor

Alex Walker

Seconded: Cr

Brent Muggeridge

THAT the next meeting of the Central

Hawke's Bay District Council be held on 30 May 2019.

Carried

|

11 Time of

Closure

The Meeting closed at 2.56pm.

The minutes of this meeting were

confirmed at the Council Meeting held on 20 June 2019.

...................................................

CHAIRPERSON

Council Meeting Agenda 20

June 2019

Council Meeting Agenda 20

June 2019

MINUTES OF Central HAwkes Bay

District Council

Extraordinary

Council Meeting

HELD AT THE Council

Chamber, 28-32 Ruataniwha Street, Waipawa

ON Thursday, 30

May 2019 AT 3.30pm

PRESENT: Mayor Alex Walker

Cr Ian Sharp (Deputy

Mayor)

Cr Shelley

Burne-Field

Cr Kelly Annand

Cr Tim Aitken

Cr Gerard Minehan

Cr Brent Muggeridge

Cr David Tennent

Dr Roger Maaka

IN ATTENDANCE:

Monique Davidson (Chief Executive)

Bronda Smith (Group

Manager, Corporate Support and Services)

Doug Tate (Group

Manager, Customer and Community Partnerships)

Nicola Bousfield

(People and Capability Manager)

Leigh Collecutt

(Governance and Support Officer)

1 Prayer

Dr Maaka opened the meeting with a prayer

2 Apologies

Leave of absence

previously granted to Cr Chote at Council meeting 10th April.

3 Declarations

of Conflicts of Interest

No conflicts were

declared

|

4 STANDING ORDERS

|

|

Resolved: 19.41

Moved: Cr

Gerard Minehan

Seconded: Cr

Kelly Annand

THAT the following standing orders are

suspended for the duration of the meeting:

20.2 Time limits on speakers

20.5 Members may speak only once

20.6 Limits on number of speakers

And that Option C under section 21

General procedures for speaking and moving motions be used for the meeting.

Standing orders are recommended to be

suspended to enable members to engage in discussion in a free and frank

manner.

Carried

|

4 Report

Section

|

Annual

Plan 3 Waters Compliance Additional Funding

|

|

PURPOSE

The matter for consideration by the Council is the

approval of additional funding required in the Annual Plan 2019/20 to support

regulated compliance work for the three waters.

|

|

Resolved: 19.42

Moved: Cr Ian Sharp

Seconded: Cr

David Tennent

That having considered all

matters raised in the report:

1) Council approve the additional budget

required in the Annual Plan 2019/20 to support regulated compliance for the

Three waters and this is loan funded to a total value of $113, 191.

Carried

|

Cr Minehan sought clarification about whether we were currently

meeting drinking water standards and wondered as we progressed whether it was

likely that we would not be meeting future requirements. The Chief

executive confirmed that what has changed are the standards for drinking water

which requires a refreshed approach to water safety plans.

Cr Burne-Field sought clarification on what planned asset management

planning work was already being done. Officers confirmed that they were

preparing for the next Long Term Plan to remodel and redevelop asset management

plans to present to elected members.

Cr Burne-Field sought clarification on whether Stormwater asset

management planning included LiDAR costs. It was confirmed that it

doesn’t specifically affect this budget due to it sitting as an overhead.

Cr Tennent sought clarification about whether funds could only

be taken from 3 water targeted rate. Officers confirmed this to be the

case.

Mayor Walker asked what the disadvantages were for option 2 around

affordability for ratepayers.

Officers noted that it would be likely that Council needed to make a

similar decision around funding three waters in 12 months’ time.

Cr Sharp moved option 2 from the report - that the activity was loan

funded to lessen impact to ratepayers. He acknowledged that this was only

a stop gap measure however that when imposing the new regulations, Central

government have inferred that funding may be available later.

Cr Tennent raised the need to loan fund despite this being an

operational matter, because the rating consequences would be too much in one

year otherwise. Seeing rates increases higher than initially

indicated. Opportunity to rationalise some other expenditure for next

year.

Cr Aitken noted his frustration that Council need to borrow money

for regulatory expense.

Challenge for a small community to be able to afford this

compliance. Cr Aitken supported the motion with reluctance but felt the

risk was too high not to.

Cr Muggeridge agreed that loan funding was the only viable

option.

Mayor Walker highlighted the risk in loan funding over a long period

of time, given likely increased costs in subsequent years. Mayor Walker

also highlighted the need to take compliance seriously and so expressed

reluctant support for the motion.

Cr Sharp reiterated how unfortunate it is that territorial

authorities must reap these costs.

|

6.2 Central

Hawke's Bay District Community Trust - Request for additional funding

|

|

PURPOSE

The purpose of this report is to present further

information to Council to determine whether to provide additional annual

funding for operational costs to the CHB Community Trust.

|

|

Resolved: 19.43

Moved: Cr Shelley

Burne-Field

Seconded: Cr Ian

Sharp

That having considered all

matters raised in the report:

a) That

Council provide additional funding to the Central Hawke's Bay District

Community Trust of $14,500 ongoing, above and beyond the current

Service Agreement value, noting an additional rating impact of $8,910 in the

2019/20 year; or

Carried

|

Mayor Walker sought clarification on what other funding is available

for trusts in this situation.

Officers confirmed that they were limited in terms of external

funding and that sponsorship is the only avenue that the trust could explore.

Cr Tennent sought clarification about whether there was an ability

for the trust to approach the operator of the pool to source extra funding.

Officers confirmed that this could be a long term option but it

would rely on renegotiation of contract with operator.

Cr Sharp commended the trust for their foresight in highlighting

this need at the time of the annual plan, rather than waiting for annual June

reporting.

Cr Minehan asked whether the trust could access any invested

reserves for increased insurance costs. Officers confirmed that there was

no money available to access as it was renewal money for governance of the

facility.

Councillor Burne-Field asked for clairifcation of the ongoing

sustainability of the trust’s capacity to get more external funding to

cover future costs.

Officers confirmed that this had been discussed with the trust and

that the initial insurance increase was higher than anticipated. There

was relative confidence that the future costs would be able to be managed in

future.

Cr Burne-Field moved option one from the officer’s report.

Cr Sharp highlighted that the cost of running the facility is

substantial however if it were a Council operated facility the cost would be

higher. Cr Sharp commended the trust for seeking best deal for insurance.

Cr Annand raised that further information had been needed to ensure

that we were supporting trust to be successful and is in support of the

motion.

Cr Tennent highlighted that the pool is a great community facility

but had concerns with the budget allocation process which made it difficult to

foresee what rates rises would be when doing Long Term Planning.

Cr Burne-Field declared an indirect conflict with her sister in law

being a trustee of the trust.

Cr Aitken raised his frustration that other options could be

explored if more time was given.

Meeting suspended at 4.05pm

Meeting reconvened at 4.08pm

Cr Annand returned to meeting at 4.09pm

5 Public

Excluded Business

RESOLUTION

TO EXCLUDE THE PUBLIC

|

Resolved: 19.44

Moved: Cr

David Tennent

Seconded: Cr

Gerard Minehan

That the public be excluded from the

following parts of the proceedings of this meeting.

The general subject matter of each matter

to be considered while the public is excluded, the reason for passing this

resolution in relation to each matter, and the specific grounds under section

48 of the Local Government Official Information and Meetings Act 1987 for the

passing of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

7.1 - Supplier Recommendation : SH2

Borefield Upgrade

|

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

7.2 - Supplier Recommendation: Otane

Alternate Supply

|

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

Carried

|

|

Resolved: 19.45

Moved: Cr

Ian Sharp

Seconded: Cr

Tim Aitken

That Council moves out of Closed Council

into Open Council.

Carried

|

6 Date

of Next Meeting

|

Resolved: 19.46

Moved: Cr

Brent Muggeridge

Seconded: Cr

Shelley Burne-Field

THAT the next meeting of the Central

Hawke's Bay District Council be held on 20 June 2019.

Carried

|

7 Time

of Closure

The Meeting closed at 4.52pm.

The minutes of this meeting were

confirmed at the Ordinary Meeting of the Council held on 20 June 2019.

...................................................

CHAIRPERSON

Council Meeting Agenda 20

June 2019

6 Reports

from Committees

6.1 Minutes

of the Hawkes Bay Drinking Water Governance Joint Committee Meeting held on 11

April 2019

File

Number: COU1-1400

Author: Leigh

Collecutt, Governance and Support Officer

Authoriser: Monique

Davidson, Chief Executive

Attachments: 1. HB

Drinking Water Joint Committee Minutes 11 April 2019 ⇩

PURPOSE

The purpose of this report is to present to Council the

minutes from the Hawke’s Bay Drinking Water Governance Joint Committee

Meeting held 11 April 2019.

|

Recommendation

That the minutes of the Hawke’s Bay Drinking

Water Governance Joint Committee held on 11 April 2019 be received.

|

Council Meeting Agenda 20

June 2019

6.2 Minutes

of the HB Civil Defence Emergency Management Group Joint Commitee meeting held

3 December 2018 and the Group Annual Report 2017-2018

File

Number: COU1-1400

Author: Leigh

Collecutt, Governance and Support Officer

Authoriser: Monique

Davidson, Chief Executive

Attachments: 1. CDEM

Minutes 3 December 2018 ⇩

PURPOSE

The purpose of this report is to present to Council the

minutes of the Hawke’s Bay Civil Defence Emergency Management Group Joint

Committee meeting held on the 3 December 2018.

|

Recommendation

That the minutes of the Hawke’s Bay Civil Defence

Emergency Management Group Joint Committee meeting held on the 3 December

2018 be received.

|

Council Meeting Agenda 20

June 2019

7 Report

Section

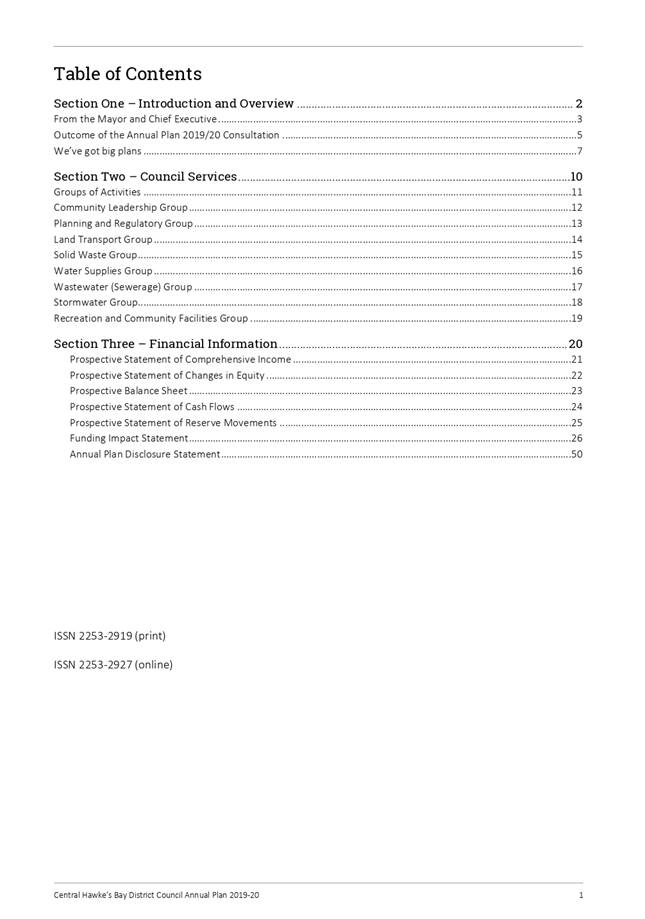

7.1 Adoption

of the Annual Plan 2019/20

File Number: ANN1-200

Author: Bronda

Smith, Group Manager, Corporate Support and Services

Authoriser: Monique Davidson, Chief Executive

Attachments: 1. Annual Plan 2019/20 ⇩

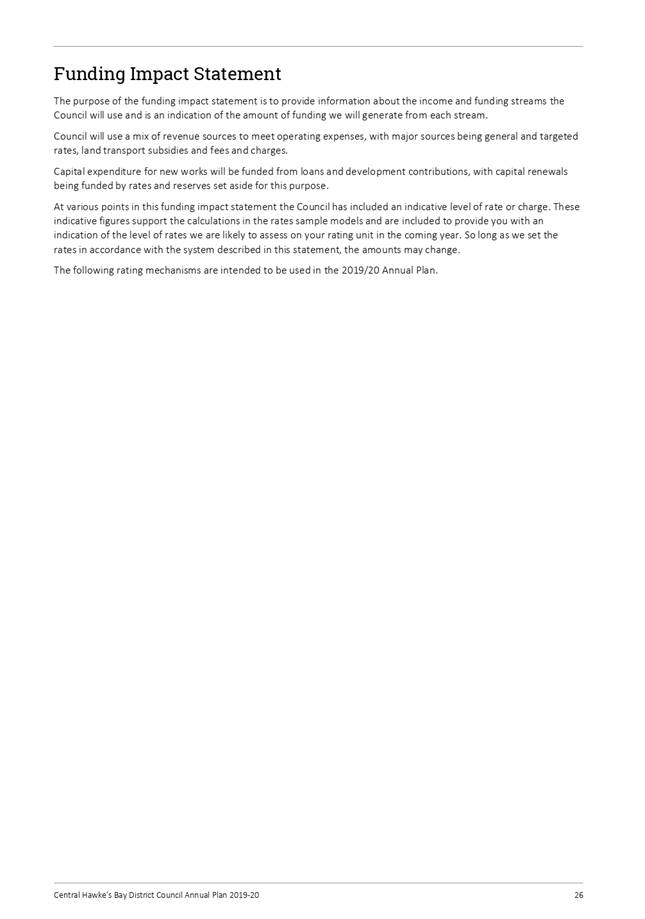

PURPOSE

The matter for consideration by the Council

is the adoption of the Annual Plan 2019-20.

|

RECOMMENDATION for consideration

That

having considered all matters raised in the report:

In

regards to the Annual Plan 2019/20 Council resolves to

a) Adopt

the Annual Plan 2019/20 in accordance with section 95 of the Local Government

Act 2002.

b) Delegate

responsibility to the Chief Executive to approve the final edits required to

the Annual Plan in order to finalise the documents for printing and

distribution.

|

|

|

|

|

compliance

|

|

|

Significance

|

This

matter is assessed as being critical

|

|

|

Options

|

This

report identifies and assesses the following reasonably practicable options

for addressing the matter:

1. In

regards to the Annual Plan 2019/20 Council resolves to

a. Adopt

the Annual Plan 2019/20 in accordance with section 95 of the Local Government

Act 2002.

b. Delegate

responsibility to the Chief Executive to approve the final edits required to

the Annual Plan in order to finalise the documents for printing and distribution.

2. Council resolves to not adopt the Annual Plan

2019/20 and to give Officers guidance on which amendments were needed and an

amended timeframe related to adoption of the Annual Plan would be required.

|

|

|

Affected persons

|

The persons who are affected by or

interested in this matter are the community of

Central Hawke’s Bay District.

|

|

|

Recommendation

|

This report recommends option 1 for addressing the matter.

|

|

|

Long-Term Plan /

Annual Plan Implications

|

The Annual Plan sets the direction and

budgets for the Council for the next year along with Year 2 of the Long Term

Plan 2018-28.

|

|

|

Significant

Policy and Plan Inconsistencies

|

There are no proposed significant

inconsistences with existing policies or plans.

|

|

EXECUTIVE SUMMARY

As part of the

purpose of Local Government, Council prepares an Annual Plan based on the

relevant year of the current Long Term Plan and following consultation if there

are significant or material changes for that year. The Council, over the last

10 months, has reviewed Year 2 of the Long Term Plan 2018-28 including how

Council will meet the current and future needs of the community for good

quality local infrastructure, local public services and the performance of its

regulatory function in a way that is most cost effective for households and

businesses. Following the review and setting of budgets, Council consulted on

the proposed Annual Plan with the community during March and April 2019 on four

items in the Consultation Document. This included the #evenbiggerwaterstory,

the Revenue and Financing Policy amendments, the establishment of an

Environmental and Sustainability Strategy and the establishment of a Disaster

Relief Fund Trust. Council received 134 submissions and heard 28 verbal

presentations of submissions. Council deliberated on the outcome of the

Consultation on 23 May 2019 and at an extraordinary meeting on the 30 May 2019.

Officers have included the decisions from the deliberations into the Annual

Plan, which is presented to the Council for consideration and adoption.

BACKGROUND

All Councils are required by section 95 of

the Local Government Act 2002 (LGA) to adopt an Annual Plan in the years

between the Long Term Plan adoption.

The Annual Plan sets out Council’s

activities, plans, budgets for the year and must be adopted before the

beginning of the year it relates to.

If there are significant or material

differences to the relevant year of the Annual Plan or the Council have items

that require consultation, part of the process of developing the Annual Plan is

to consult with the public on the activities, plans, budgets of Council. The

Consultation Document and Supporting Information is prepared and adopted under

the requirements of section 82 of the Local Government Act 2002. The purpose of

the Consultation Document is to provide the community with an effective basis

for public participation in local authority decision making relating to the

Annual Plan (section 95A of the LGA).

The process to develop the Annual Plan

began in September 2018. Since this time workshops have been held to review

Year 2 of the Long Term Plan 2018-28 and to develop the plans and budgets for

the 2019/20 year.

During the workshops, Council has reviewed

all the components of the Annual Plan including:

· Revenue and Finance Policy –this has been reviewed and a

Statement of Proposal was consulted on in conjunction with the Annual Plan.

· The Budget and Rates requirements for the next year - these have

been reviewed and formed part of the overall consultation on the Annual Plan.

In accordance with section 95A of the LGA,

officers developed a Consultation Document and Supporting Information that

reflected the decisions made and to provide the basis for consultation with the

community. The Consultation Document set out the issues and opportunities

facing Central Hawke’s Bay, along with the key issues for consultation to

inform the final Annual Plan and the proposals and options put forward by

Council. The Supporting Information includes the detailed information relied on

to prepare the consultation document.

The consultation on the Annual Pan using

the Consultation Document and Supporting Information was be done in accordance

with section 82 of the LGA.

Following the adoption of the Consultation,

Council held 7 Have Your Say meetings to discuss the Annual Plan and for the

community to give feedback to the Council. Over the Consultation Period Council

received 134 submissions. At the Hearings meeting, Council heard 28 verbal

presentations of submissions. On 23 May 2019, Council held a Deliberations

meeting to decide on the outcome of the Consultation items and other items

raised during submissions and an extraordinary Council meeting was held on 30

May 2019 to allow for additional information to be provided for the

deliberations.

For the four key initiatives Council

consulted, the following was resolved:

1. To tag $250,000 from the Rural Wards Reserve Funds to

support water security initiatives in Central Hawke’s Bay. It was also

resolved to develop a framework that investigates the issues of water security

to create a local package of solutions, which includes the potential role of

Central Hawke’s Bay District Council, Water Holdings CHB Limited,

Hawke’s Bay Regional Council, the Tukituki Taskforce and other community

groups.

2. To adopt the changes to the Revenue and Financing

Policy consulted on during the Annual Plan consultation.

3. To adopt the Environmental and Sustainability

Strategy which sets the direction for how the Council will manage its impact on

the environment for years to come.

4. To establish a regional Disaster Relief Trust between

the five Hawke’s bay Local Authorities to assist with the distribution of

donations following a disaster.

Officers have included the decisions from

the deliberations into the Annual Plan, which is presented to the Council for

consideration and adoption.

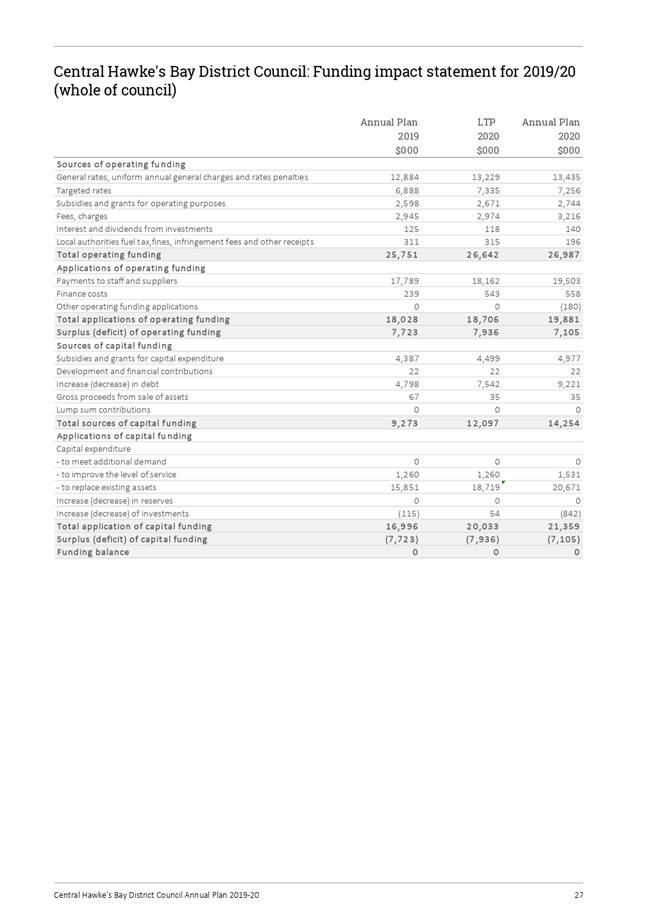

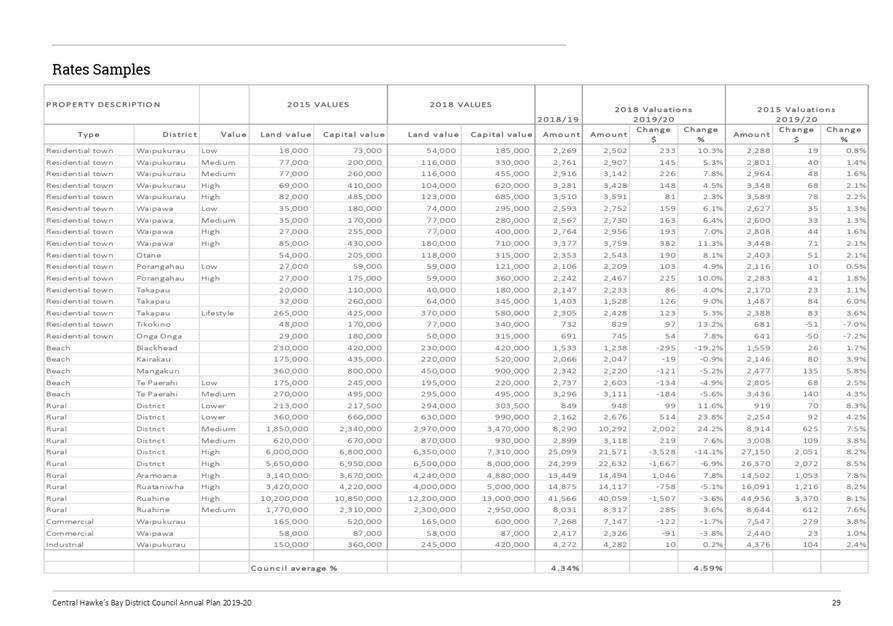

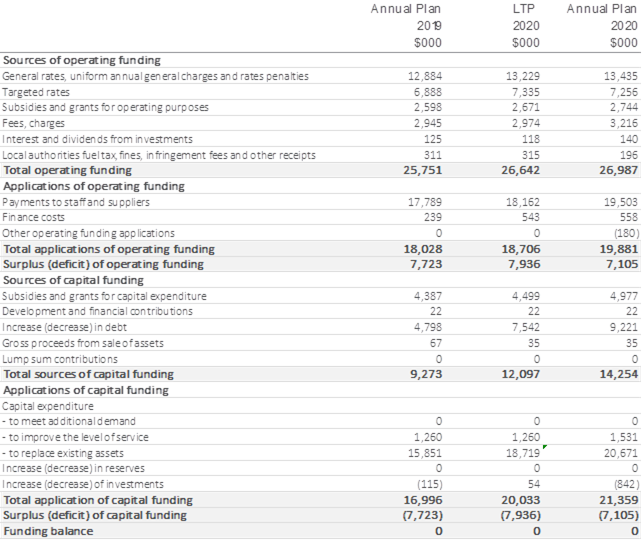

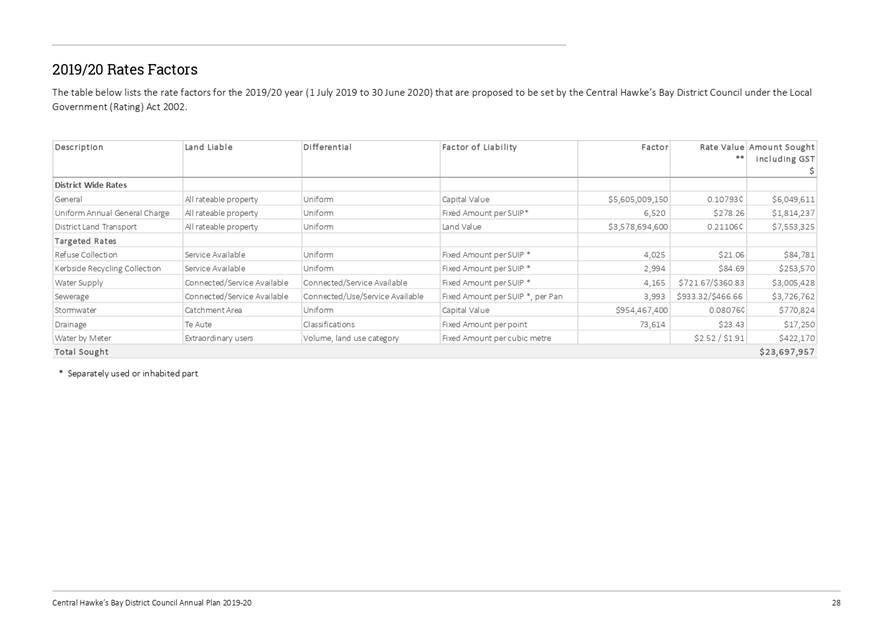

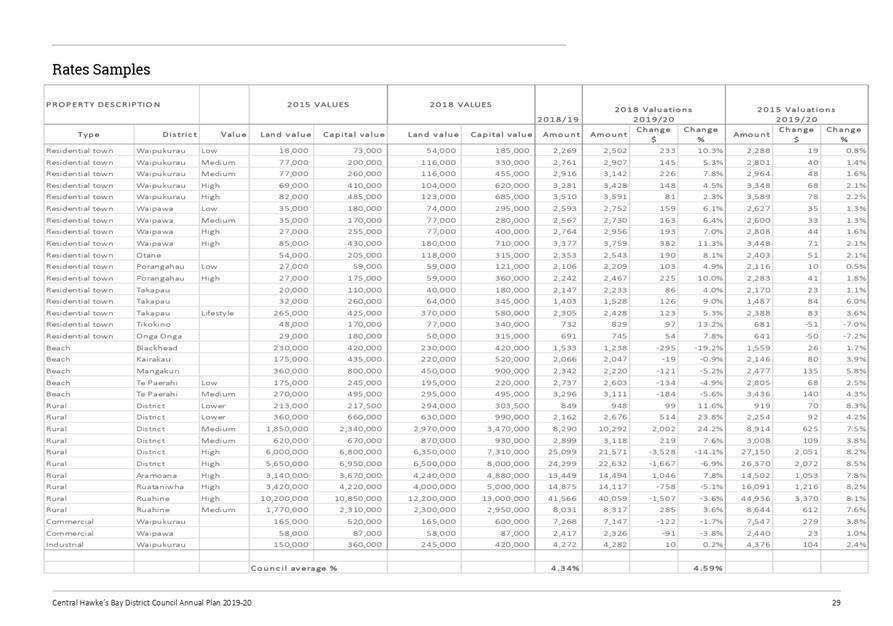

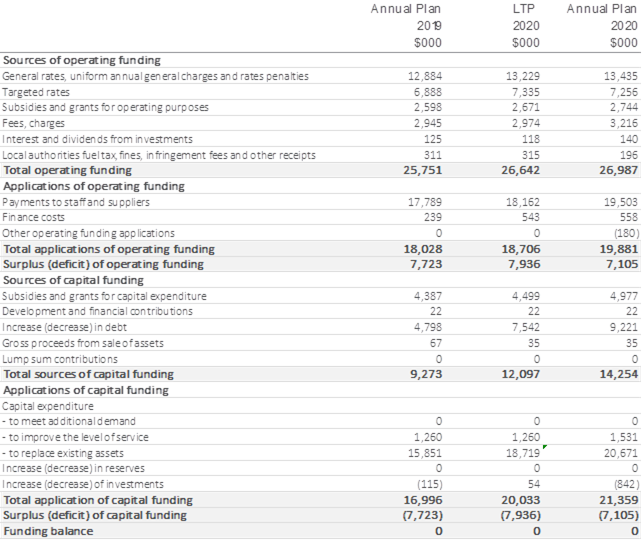

The Annual Plan includes Rate Increases of

4.59% which is a 0.55% increase on the Rates increase proposed for Year 2 of

the Long Term Plan 2018-28.

It is important to note that while

reviewing the capital programme for the Annual Plan and subsequent years,

Council continues to deal with the issue of breaching resource consent

requirements at the Waipukurau and Waipawa Wastewater Treatment Plants. The

Wastewater review has developed options in response to the Environment Court

Order which requires a report to go to the Court prior to the 30 June 2019.

There is more investigation work to do to further develop the best practicable

options. This is likely to result in an amendment to the Long Term Plan for the

2019/20 financial year.

SIGNIFICANCE AND ENGAGEMENT

In accordance with the Council's

Significance and Engagement Policy, this matter has been assessed as critical because it

affects the ability of the Council to meet its statutory purpose and is

fundamental to how the Council will fund these activities over the next year.

This matter impacts all the residents and ratepayers of the Central

Hawke’s Bay District. A number of channels were used to encourage the

community to participate in the consultation process. This included a

number of public meetings, radio advertisements, social and print media

campaigns, as well as inserts in the CHB Mail. Consultation documents

were also sent to ratepayers who live out of the district.

OPTIONS

The

following assessment relates to all options

a) Financial

and Resourcing Implications

The Annual Plan is a key plan of

Council for the service provision and the financial management and funding of

Council. The adoption of the Annual Plan is critical for the Council to be able

to set rates for the financial year and allows the Council to collect the rates

required to deliver the service of Council.

b) Risk

Analysis

Council is required to adopt the

Annual Plan in accordance with the LGA. All processes in the production of the

Annual Plan have been in accordance with the LGA.

c) Promotion

or Achievement of Community Outcomes

The Annual Plan is a key plan for

the financial year in achieving the Community Outcomes included in the Long

Term Plan.

d) Statutory

Responsibilities

Council is required to adopt the

Annual Plan in accordance with the LGA. Schedule 10 of the LGA set out the

contents of the Annual Plan and Section 82 sets out the Consultation Principles

that must be followed to formally consult on the Annual Plan. Council is also

required to adopt the Annual Plan prior to the start of the year cover by the

plan which requires Council to adopt the Annual Plan by 30 June 2019.

e) Consistency

with Policies and Plans

The Annual Plan has been developed

in compliance with the policies of Council.

f) Participation

by Māori

The representative of the Maori

Consultative Committee, Roger Maaka was present during the workshops and

Council meetings in the preparation of the Annual Plan.

g) Community

Views and Preferences

As part of the process of developing

the Annual Plan, Council is required to consult using Section 82 of the LGA

therefore the wider community was part of the formal process. Council also

engagement with the community during Project Thrive which was a key component

in the development of the LTP which is the basis of the Annual Plan.

Option 1

In regards

to the Annual Plan 2019/20 Council resolves to

a. Adopt

the Annual Plan 2019/20 in accordance with section 95 of the Local Government

Act 2002.

b. Delegate

responsibility to the Chief Executive to approve the final edits required to

the Annual Plan in order to finalise the documents for printing and

distribution.

Option 2

Council resolves to not adopt the Annual Plan 2019/20 and to give

Officers guidance on which amendments were needed and an amended timeframe

related to adoption of the Annual Plan would be required

NEXT STEPS

Following the

adoption of the Annual Plan, Council with set the rates for the year of the

Annual Plan and a report is included within the agenda of the Council meeting

for the setting of the rates.

The Group Manager – Corporate Support

and Services, in conjunction with the Chief Executive will make any minor

amendments and distributed the Annual Plan as required.

Council Officers will also respond to all

the submissions with the outcome of the deliberations and information adopted

as part of the Annual Plan.

Should the Council resolve to not adopt the

Annual Plan, officers will be require guidance on which amendments are needed

and an amended timeframe related to adoption of the Annual Plan would be

required

Recommended Option

This report recommends option 1 for

addressing the matter.

|

RECOMMENDATION

for consideration

That

having considered all matters raised in the report:

In

regards to the Annual Plan 2019/20 Council resolves to

a) Adopt

the Annual Plan 2019/20 in accordance with section 95 of the Local Government

Act 2002.

b) Delegate

responsibility to the Chief Executive to approve the final edits required to

the Annual Plan in order to finalise the documents for printing and

distribution.

|

Council Meeting Agenda 20

June 2019

7.2 Fees

and Charges 2019/20

File Number: COU1-1400

Author: Bronda

Smith, Group Manager, Corporate Support and Services

Authoriser: Monique Davidson, Chief Executive

Attachments: 1. Schedule of Fees and Charges

2019/20 ⇩

PURPOSE

The matter for consideration by the Council

is the adoption of the Fees and Charges for 2018/19

|

RECOMMENDATION for consideration

That

having considered all matters raised in the report:

a) That

the Fees and Charges for the financial year dated 2019/20 as set out in

Attachment A excluding Animal Control Fees be approved.

b) That

Council give notice pursuant to Section 103 of the Local Government Act 2002

of its intention to prescribe the fees payable for the period 1 July 2019 to

30 June 2020 in respect of certificates, authorities, approvals, consents,

and services given or inspections made by the Council under the Local Government

Act 2002, the Building Act 2004, the Building (Infringement Offences, Fees,

and Forms) Regulations 2007, the Amusement Devices Regulations 1978, the

Resource Management Act 1991, Health (Registration of Premises) Regulations

1966, Sale and Supply of Alcohol (Fees) Regulations 2013, the Gambling Act

2003, the Burial and Cremation Act 1964, and the Central Hawke’s Bay

District Council Bylaws as set out in the Fees and Charges Schedule 2019/20.

|

|

|

|

compliance

|

|

Significance

|

This

matter is assessed as being significant

|

|

Options

|

This

report identifies and assesses the following reasonably practicable options

for addressing the matter:

1. That the Fees and Charges

for the financial year dated 2019/20 as set out in Attachment A excluding

Animal Control Fees be approved.

2. Retain the current fee

structure.

|

|

Affected persons

|

The persons who are affected by or

interested in this matter are the community of Central Hawkes Bay District

Council.

|

|

Recommendation

|

This report recommends option 1 for addressing the matter.

|

|

Long-Term Plan /

Annual Plan Implications

|

The Fees and Charges are a material

component of the revenue of Council and therefore have an implication for

being able to meet the Long Term Plan budgets if the current fee structure is

maintained.

|

|

Significant

Policy and Plan Inconsistencies

|

No

|

BACKGROUND

As part of the Annual Plan, Council has

reviewed the Schedule of Fees & Charges and has consulted on the charges as

part of the Annual Plan consultation process.

The fees and charges noted in the schedule

for 2019/20 relate to certificates, approvals, consents, and services given or

inspections made by the Council under the Local Government Act 2002, the

Building Act 2004, the Building (Infringement Offences, Fees, and Forms)

Regulations 2007, the Amusement Devices Regulations 1978,the Resource

Management Act 1991, Health (Registration of Premises) Regulations 1966, Sale

and Supply of Alcohol (Fees) Regulations 2013, the Gambling Act 2003, the Burial

and Cremation Act 1964, and the Central Hawke’s Bay District Council

Bylaws as set out in the Schedule of Fees and Charges 2018/2019.

Council is required under Section 103 of

the Local Government Act 2002, to give notice of its fees and charges payable

for the period 1 July 2019 to 30 June 2020 as part of the Revenue and Financing

Policy.

SIGNIFICANCE AND ENGAGEMENT

In accordance with the Council's

Significance and Engagement Policy, this matter has been assessed as significant because

it has a material impact on the Council’s abilities to deliver the

services included in the Long Term Plan.

OPTIONS

Option 1

That the Fees and Charges for the financial year dated 2019/20 as

set out in Attachment A excluding Animal Control Fees be approved

That Council give notice pursuant to Section 103 of the Local

Government Act 2002 of its intention to prescribe the fees payable for the

period 1 July 2019 to 30 June 2020 in respect of certificates, authorities,

approvals, consents, and services given or inspections made by the Council

under the Local Government Act 2002, the Building Act 2004, the Building

(Infringement Offences, Fees, and Forms) Regulations 2007, the Amusement

Devices Regulations 1978, the Resource Management Act 1991, Health

(Registration of Premises) Regulations 1966, Sale and Supply of Alcohol (Fees)

Regulations 2013, the Gambling Act 2003, the Burial and Cremation Act 1964, and

the Central Hawke’s Bay District Council Bylaws as set out in the Fees

and Charges Schedule 2019/20.

a) Financial

and Resourcing Implications

This option ensures that Council is

able to meet the budgets within the Annual Plan.

b) Risk

Analysis

There is no risk assessed with this

option.

c) Alignment

to Project Thrive and Community Outcomes

This aligns with the Council’s

Community Outcomes.

d) Statutory

Responsibilities

Council is required to adopt the

Fees and Charges prior to charging the fees based on the legislative

requirements that the Fees and Charges are set under.

e) Consistency

with Policies and Plans

This is consistent with the Annual

Plan 2019/20.

f) Participation

by Māori

There are no specific implications

for Māori regarding the setting of the rates.

g) Community

Views and Preferences

The views of the community and

preferences were considered as part of the special consultative process run as

part of the Annual Plan process

h) Advantages

and Disadvantages

Approval of the Fees and Charges in

the attachment allows Council to remain within the budgets included in the

Annual Plan.

Option 2

Retain the current fee structure

a) Financial

and Resourcing Implications

This option has material

implications to meeting the budgets within the Annual Plan.

b) Risk

Analysis

There is risk in this option to

meeting the budgets within the Annual Plan.

c) Promotion

or Achievement of Community Outcomes

This aligns with

the Council’s Community Outcomes.

d) Statutory

Responsibilities

There is no statutory

responsibilities in this option as the current fee structure has already been

adopted by Council

e) Consistency

with Policies and Plans

This option is not consistent with

the Annual Plan

f) Participation

by Māori

There are no specific implications

for Māori regarding the setting of the rates.

g) Community

Views and Preferences

This would be inconsistent with the

consultative process run as part of the Annual Plan process

h) Advantages

and Disadvantages

This option has material

implications to meeting the budgets within the Annual Plan.

NEXT STEPS

Following the approval of the Schedule for

Fees and Charges, from the 1st July 2019, the Fees and Charges will

be updated on all forms and on the website.

Recommended Option

This report recommends option 1 for

addressing the matter.

|

RECOMMENDATION

for consideration

That

having considered all matters raised in the report:

a) That

the Fees and Charges for the financial year dated 2019/20 as set out in

Attachment A excluding Animal Control Fees be approved.

b) That

Council give notice pursuant to Section 103 of the Local Government Act 2002

of its intention to prescribe the fees payable for the period 1 July 2019 to

30 June 2020 in respect of certificates, authorities, approvals, consents,

and services given or inspections made by the Council under the Local Government

Act 2002, the Building Act 2004, the Building (Infringement Offences, Fees,

and Forms) Regulations 2007, the Amusement Devices Regulations 1978, the

Resource Management Act 1991, Health (Registration of Premises) Regulations

1966, Sale and Supply of Alcohol (Fees) Regulations 2013, the Gambling Act

2003, the Burial and Cremation Act 1964, and the Central Hawke’s Bay

District Council Bylaws as set out in the Fees and Charges Schedule 2019/20.

|

Schedule of Fees and Charges

Leadership and

Governance Group

There are

no applicable charges in this activity area.

Planning and Regulatory Group

|

Resource Management

|

excl

GST

|

GST

|

incl

GST

|

|

Notes:

§ Pursuant

to Section 36, 36(1) and 36(3) of the Resource Management Act 1991, Council

may require the person who is liable to pay one or more of the below charges,

to also pay an additional charge to recover actual and reasonable costs in

respect of the matter concerned.

§ These

set fees relate to the minimum administration charge only. The actual

fee payable includes the cost of time taken to process each application,

memorandum, consent, certificate or schedule and the cost of the inspections

required.

§ Extra

charges will be applicable for development levies. These will be

assessed on a case by case basis. Please contact Council for exact

costs.

|

|

Land

Use and Subdivision Consents

|

|

Notified

Applications (Deposit)

|

$3,478.26

|

$521.74

|

$4,000.00

|

|

Non

Notified Applications (Deposit)

|

$869.57

|

$130.43

|

$1000.00

|

|

Deemed

Permitted Boundary Activity (s87AAB)

|

$156.52

|

$23.48

|

$180.00

|

|

Fast-Track

Application (s87AAC) (Deposit)

|

$695.65

|

$104.35

|

$800.00

|

|

Variation

of Conditions of Consents (s127)(Deposit)

|

$869.57

|

$130.43

|

$1000.00

|

|

Extension

of Time Application (s125) (Deposit)

|

$695.65

|

$104.35

|

$800.00

|

|

Certificate

of Compliance (s139) (Deposit)

|

$521.74

|

$78.26

|

$600.00

|

|

ROW

application (S348 LGA)

|

$869.57

|

$130.43

|

$1000.00

|

|

Bond

Administration Fee

|

$130.43

|

$19.57

|

$150.00

|

|

Inspection

Fee – Zone 1

|

$173.91

|

$26.09

|

$200.00

|

|

Inspection

Fee – Zone 2

|

$182.61

|

$27.39

|

$210.00

|

|

Inspection

Fee – Zone 3

|

$200.00

|

$30.00

|

$230.00

|

|

Inspection

Fee – Zone 4

|

$226.09

|

$33.91

|

$260.00

|

|

Inspection

Fee – Outside Zone 4

|

$260.87

|

$39.13

|

$300.00

|

|

Travel

Costs (per km)

|

$0.87

|

$0.13

|

$1.00

|

|

Sale of

Liquor Certificate (RMA)

|

$86.96

|

$13.04

|

$100.00

|

|

Objection

of RMA decisions (Section 357)

|

$869.57

|

$130.43

|

$1,000.00

|

|

Subdivisions

|

|

Subdivision

Consents 1-8 Lots (Deposit)

|

$1,043.48

|

$156.52

|

$1,200.00

|

|

Subdivision

Consents more than 8 Lots (Deposit)

|

$2,086.96

|

$313.04

|

$2,400.00

|

|

Subdivision

Compliance Fee (section 223 and/or 224 Resource Management Act 1991)

|

$347.83

|

$52.17

|

$400.00

|

|

Subdivision

Compliance Fee (section 223 and/or 224 Resource Management Act 1991) - more

than 10 lots

|

$1,304.35

|

$195.65

|

$1,500.00

|

|

Consent

Notices and miscellaneous subdivision documents (ie: Deamalgamation

Certification s241(3), Cancellation of Easement s243(e ), Certificate

Confirming Allotments s226(e )(ii)

|

$130.43

|

$19.57

|

$150.00

|

|

Bundled

Consents

|

|

Combined

Land Use and Subdivision Consent (Deposit)

|

$1,739.13

|

$260.87

|

$2,000.00

|

|

Monitoring

and Compliance

|

|

Monitoring

fee (per hour)

|

$139.13

|

$20.87

|

$160.00

|

|

Engineering

Plan Approval

|

Actual

and reasonable costs

|

|

Chargeout

Rates per Hour

|

|

Administration

|

$113.04

|

$16.96

|

$130.00

|

|

Planner,

compliance and monitoring

|

$139.13

|

$20.87

|

$160.00

|

|

Senior

Planner

|

$147.83

|

$22.17

|

$170.00

|

|

Manager,

Team Leader and Engineers

|

$165.22

|

$24.78

|

$190.00

|

|

Administrative

Charges

|

|

Supply

of documents

|

Photocopying

costs

|

|

District

Plan Charges

|

|

Private

District Plan Change (Deposit)

|

$13,043.48

|

$1,956.52

|

$15,000.00

|

|

Designations

and heritage orders (New and alterations) (deposit)

|

$1,304.35

|

$195.65

|

$1,500.00

|

|

District

Plan (including Planning Maps) Hardcopy

|

Actual

and reasonable costs

|

|

District

Plan (including Planning Maps) Electronic

|

$43.48

|

$6.52

|

$50.00

|

|

Sec 224

12 Month Maintenance Bond for subdivision works equal to 5% of the cost of

the construction works.

|

Building Consents

|

|

|

|

NOTES:

§ Building consent deposit payable on application.

§ The actual fee payable includes the cost of time

taken to process each application, project information memorandum, building

consent or compliance schedule and the cost of the inspections required.

§ Extra charges will be applicable for development

levies. These will be assessed on a case by case basis. Please

contact Council for exact costs.

§ Deposits are based on adequate documentation

being provided to Council at the time of application and a set number of

inspections. Further charges will be incurred should further work be

required during processing and issuing consent or should extra inspections be

required.

§ It is anticipated that the scheduled deposit will

cover some of Council's actual and reasonable expenses. Where

additional costs are incurred, the applicant will be charged

accordingly. Where, upon issue of a Code of Compliance Certificate, the

deposit is found to exceed the actual and reasonable cost, a refund will be

made.

§ Building Research Association and Department of

Building and Housing levies are additional to the above at the Rates

specified from time to time by the Association.

§ Pursuant to Building Research Association

Legislation, materials, labour and plant costs must be included in the total

value of building work for the calculation of levies.

§ The accreditation fee is to cover continuing

Central Government accreditation costs relating to the Building Act 2004.

|

|

Consent

Fees

|

excl

GST

|

GST

|

incl

GST

|

|

Solid

Fuel Burner – Free Standing (including accreditation fee) (deposit)

plus travel fees

|

$226.09

|

$33.91

|

$260.00

|

|

Solid

Fuel Burner – In Built (including accreditation fee) (deposit) plus

travel fees

|

$308.70

|

$46.30

|

$355.00

|

|

Marquee

Consent / Inspection Fee

|

$156.52

|

$23.48

|

$180.00

|

|

Minor

plumbing and drainage works including new connections, replacement septic

tanks and effluent fields, demolition work and swimming pool fences (deposit)

|

$330.43

|

$49.57

|

$380.00

|

|

Additions

and alterations or similar building works up to value of $50,000 (deposit)

|

$608.70

|

$91.30

|

$700.00

|